Sonin Company purchased and installed electronic payment equipment at its drive-in restaurant at the beginning of the

Question:

Sonin Company purchased and installed electronic payment equipment at its drive-in restaurant at the beginning of the year at a cost of $27,000. The equipment has an estimated residual value of $1,500. The equipment is expected to process 255,000 payments over its three-year useful life. Per year, expected payment transactions are 61,200 in year 1, 140,250 in year 2, and 53,550 in year 3.

Required:

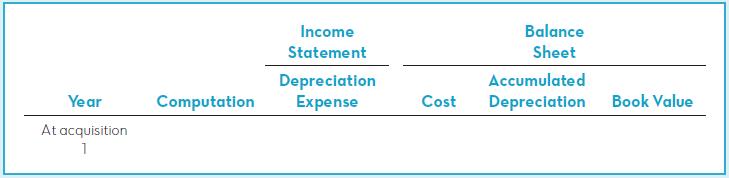

Complete a depreciation schedule for each of the alternative methods:

a. Straight-line

b. Units-of-production

c. Double-declining-balance

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh

Question Posted: