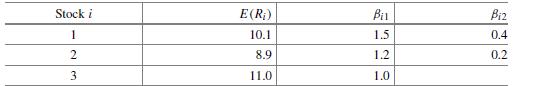

Consider the following APT model: Suppose that the riskless rate R f = 5%, and we have

Question:

Consider the following APT model:

![]()

Suppose that the riskless rate Rf = 5%, and we have the following data for three stocks.

(a) What are the risk premiums of the factors, i.e., γ1 and γ2?

(b) What are the expected values of the factors?

(c) What is the stock risk premium for each stock?

(d) What is β3,2?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Investment Valuation And Asset Pricing Models And Methods

ISBN: 9783031167836

1st Edition

Authors: James W. Kolari, Seppo Pynnönen

Question Posted: