Mr. Spice wonders how a fixed-income manager could position his portfolio to capitalize on the expectation of

Question:

a. Sell bonds and buy notes.

b. Buy bonds and sell notes.

c. Buy both bonds and notes.

Frank Myers, CFA, is a fixed-income portfolio manager for a large pension fund. A member of the Investment Committee, Fred Spice, is very interested in learning about the management of fixed income portfolios. Mr. Spice has approached Mr. Myers with several questions.

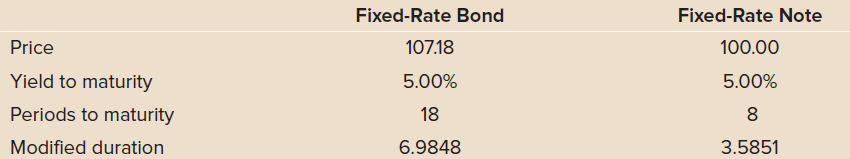

Mr. Myers has decided to illustrate fixed-income trading strategies using a fixed-rate bond and note. Both bonds have semiannual coupons. Unless otherwise stated, all interest rate changes are parallel. The characteristics of these securities are shown in the table below.

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted: