Mr. Wall is a little confused over the relationship between the embedded option and the callable bond.

Question:

a. It increases.

b. It may increase or decrease.

c. It decreases.

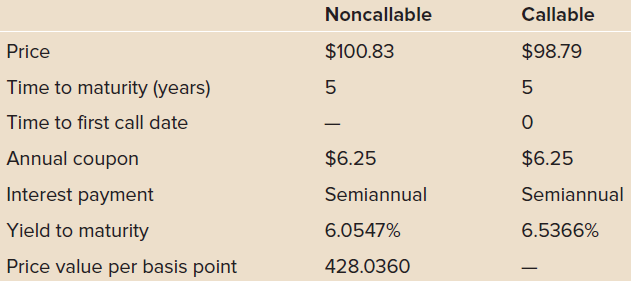

Patrick Wall is a new associate at a large international financial institution. Mr. Wall recently completed his finance degree and is currently a CFA Level 1 candidate. Mr. Wall€™s new position is as the assistant to the firm€™s fixed-income portfolio manager. His boss, Charles Johnson, is responsible for familiarizing Mr. Wall with the basics of fixed-income investing. Mr. Johnson asks Mr. Wall to evaluate the bonds shown below. The bonds are otherwise identical except for the call feature present in one of the bonds. The callable bond is callable at par and exercisable on the coupon dates only.

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted: