She would like to compute the value of the corresponding put option for Option 1. Which of

Question:

a. $3.79

b. $3.94

c. $4.41

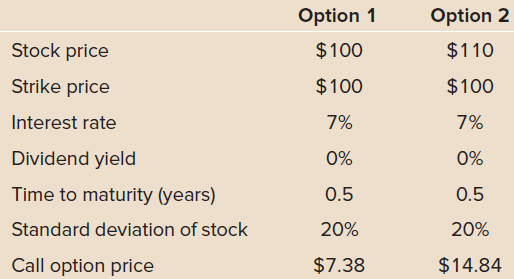

Rachel Barlow is a recent finance graduate from Columbia University. She has accepted a position at a large investment bank but must first complete an intensive training program. Currently she is spending three months at her firm€™s Derivatives Trading Desk. To prepare for her assignment, Ms. Barlow decides to review her notes on option relationships, concentrating particularly on put-call parity. The data she will be using in her review are provided below. She also decides to assume continuous compounding.

Option 1 Option 2 Stock price $100 $110 Strike price $100 $100 7% Interest rate 7% Dividend yield 0% 0% Time to maturity (years) 0.5 0.5 Standard deviation of stock 20% 20% Call option price $7.38 $14.84

Step by Step Answer:

b Putcall parity states S V ...View the full answer

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Related Video

A put option is a financial contract that gives the owner the right, but not the obligation, to sell an underlying asset, such as a stock or a commodity, at a predetermined price, known as the strike price, on or before a specific date, known as the expiration date. Put options are used by investors as a form of insurance against a decline in the value of the underlying asset. If an investor expects the value of an asset to fall in the future, they can purchase a put option on that asset. If the value of the asset does fall, the put option will increase in value, allowing the investor to sell the asset at the higher strike price. For example, if an investor owns 100 shares of a stock that is currently trading at $50 per share, they may purchase a put option with a strike price of $45 and an expiration date three months in the future. If the stock price falls to $40 before the expiration date, the investor can exercise the put option and sell their shares for $45 each, even though the market price is only $40. This would allow the investor to limit their losses. It\'s important to note that purchasing a put option involves paying a premium to the seller of the option, and the investor can lose the entire premium if the price of the underlying asset does not decline as expected. Put options are just one type of financial derivative and should only be used by experienced investors who understand the risks involved.

Students also viewed these Business questions

-

Using the information provided in 10-33, compute the value of the bond on January 2, 2017, assuming interest rates do not change. What return would investors earn in 2016? What would be the capital...

-

A student has seven books that she would like to place in her backpack. However, there is room for only four books. Regardless of the arrangement, how many ways are there of placing four books into...

-

Using the information provided in 10-33, compute the value of the bond on January 2, 2013, assuming interest rates do not change. What return would investors earn in 2012? What would be the capital...

-

Calculate the Total Cost of Ownership of the following 2 models and determine which model is a better buy. Model X Model Y $50,000 $60,000 Purchase price = Expected useful life = Maintenance cost per...

-

A lunar vehicle is tested on Earth at a speed of 10 km/h. When it travels as fast on the Moon, is its momentum more, less, or the same?

-

Suppose that when the radius of a circle is measured, an error is made that has a n(0, 2) distribution. If n independent measurements are made, find an unbiased estimator of the area of the circle....

-

Describe some of the more common criminal offenses that occur in healthcare settings.

-

A photocopy machine company produces three types of laser printersthe Print Jet, the Print Desk, and the Print Prothe sale of which earn profits of $60, $90, and $73, respectively. The Print Jet...

-

Kendra, Cogley, and Mei share income and loss in a 3:2:1 ratio (in ratio form: Kendra, 3/6; Cogley, 2/6; and Mei, 1/6). The partners have decided to liquidate their partnership. On the day of...

-

The Heinrich Company manufactures two types of plastic hanger racks (Foldaways and Straightaways) especially suited for mounting near clothes dryers. Because permanent press clothing must be hung on...

-

You are short 15 March 2016 corn futures contracts. Calculate your dollar profit or loss from this trading day using Figure 14.1. Figure 14.1 Metal & Petroleum Futures Contract Open Chg Interest...

-

Jed Clampett just dug another oil well, and, as usual, its a gusher. Jed estimates that in two months, hell have 2 million barrels of crude oil to bring to market. However, Jed would like to lock in...

-

Estimate the energy of the dispersion interaction (use the London formula) for two He atoms separated by 1.0nm. Relevant data can be found in the Resource section.

-

4. (12 pts.) Given the sequential logic circuit below, complete the timing waveforms for the outputs, assuming the storage elements have zero propagation delays. Initial values of OUTA and OUTB are...

-

Calculate the maximal weight this girl can hold before toppling, given the following information: mw = ??? MUB = 43 kg LL m = 21 kg MRL = 21 kg mw - ankle = 0.45 m MUB - ankle = 0.31 m mL - ankle =...

-

Show transcribed image text You are an accountant working at Robi & Co. George Maranzan, a partner in your firm, leaves you the following voicemail message: "The scheduling manager tells me you...

-

01. .05 points, At least 10 words > Use the definition below to explain in detail where, when, how and why Meena and her family became refugees. In order to get credit for your answer, you must...

-

reference Arranged Arranged (201 and be sure to explain and defend your respons 06..05 points, At least 10 words > Which character in Arranged (2017), (assigned directly above, quick link here...

-

In Fig. 40.28, how does the probability of finding a particle in the center half of the region -A < x < A compare to the probability of finding the particle in the outer half of the region? Is this...

-

Saccharin is an artificial sweetener that is used in diet beverages. In order for it to be metabolized by the body, it must pass into cells. Below are shown the two forms of saccharin. Saccharin has...

-

Why are systems for collaboration and social business so important, and what technologies do they use? a. Define collaboration and social business and explain why they have become so important in...

-

What is the role of the information systems function in a business? a. Describe how the information systems function supports a business. b. Compare the roles played by programmers, systems analysts,...

-

What is the impact of information systems on organizations? a. Describe the major economic theories that help explain how information systems affect organizations. b. Describe the major behavioral...

-

Watch the recorded interview of Ms . Veronica Trammell, Executive Director of Learning Technology at KSU. The interview focused on service management and service operation. Share your thoughts in...

-

develop a detailed event plan following the assigned event type and theme with the following information: Event objectives based on the assigned event type and theme Two sets of varying food &...

-

Provide a detailed simulation performance results for Walmart inc. based on 5 year performance review.

Study smarter with the SolutionInn App