Babbit, Inc., a multinational corporation based in the United States, owns an 80% 2024 in Nakima Company,

Question:

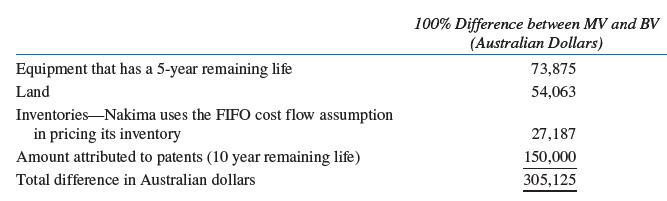

Babbit, Inc., a multinational corporation based in the United States, owns an 80% 2024 in Nakima Company, which is located in Sydney, Australia. The acquisition occurred on January 1, 2024. The difference between the implied value of 810,625 Australian dollars and the book value of Nakima equity was attributed to specific assets of Nakima Company as follows:

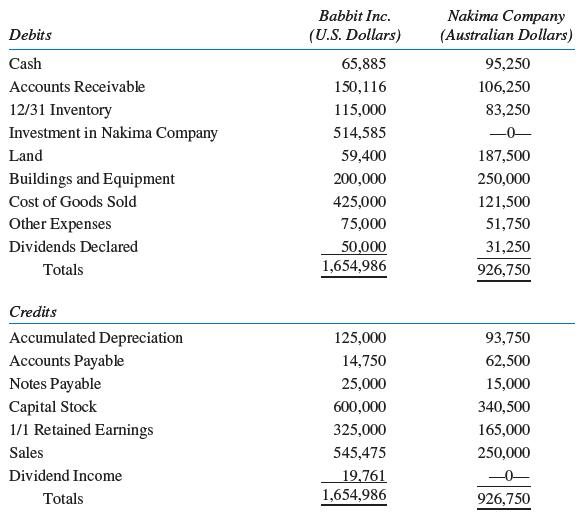

Ignore deferred income taxes in the assignment of the difference between implied and book value. The adjusted trial balances for the two companies on December 31, 2024 are presented here:

Additional Information:

1. Sales, purchases, and other expenses were incurred evenly during the year.

2. Dividends of 15,625 Australian dollars were paid on April 30 and October 31.

3. The accounts are presented in conformity with U.S. generally accepted accounting principles.

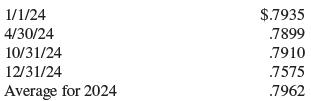

4. Direct rates of exchange.

5. The Australian dollar is identified as the functional currency of Nakima Company.

Required:

A. Prepare a workpaper to translate the trial balance of the subsidiary into U.S. dollars.

B. Prepare a schedule to verify the translation adjustment.

C. Prepare journal entries on the books of the parent company to record the purchase of the 80% interest in the subsidiary and to apply the cost method of accounting.

D. Prepare a consolidated statements workpaper at December 31, 2014. Journal entries made in requirement C that are not reflected in the trial balance of Babbit, Inc. are to be made as adjusting entries in the elimination columns of the workpaper.

Step by Step Answer: