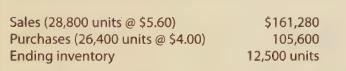

On December 31, 20X2, the accounting records of Zylar, Inc., show the following unit sales for 20X2.

Question:

On December 31, 20X2, the accounting records of Zylar, Inc., show the following unit sales for 20X2.

![]()

The following are additional actual amounts for the 4th quarter of 20X2.

Management has established a unit sales goal of 130,000 units for 20X3 and 24,000 units for the first quarter of 20X4. The sales manager, after reviewing price trends and checking with the company’s merchandise suppliers, projects that the unit cost of merchandise will increase from \($4.00\) to \($4.25\) in the first quarter of 20X3.

Because of the increase in costs, the company will need to increase its unit sales price from \($5.60\) to \($6.00\) in the first quarter of 20X3.

After considering the time required to reorder merchandise, the sales manager requests that 40.0% of each quarter's unit sales be available in the prior quarter’s ending inventory.

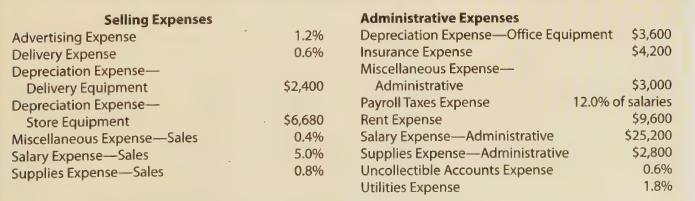

Expenses are projected as shown below. Except where noted, percentages are based on quarterly projected net sales. For these items, calculate each quarter's amount by multiplying the percentage times that quarter's net sales. Calculate the annual total by adding the four quarterly amounts. When a dollar amount is given, the total amount should be divided equally among the four quarters.

Interest expense for each quarter is projected to be \($1,250.\)

Federal income taxes are calculated using the tax rate table shown in this chapter. Equal quarterly income tax payments are based on the projected annual federal income tax expense. '

Additional information is as follows:

a. The balance of cash on hand on January 1, 20X3, is \($41,600.\)

b. In each quarter, cash sales are 10.0% and collections of accounts receivable are 40.0% of the projected net sales for the current quarter. Collections from the preceding quarter's net sales are 49.4% of that quarter.

Uncollectible accounts expense is 0.6% of net sales.

c. In each quarter, cash payments for cash purchases are 10.0% and for accounts payable 55.0% of the purchases for the current quarter. Cash payments for purchases of the preceding quarter are 35.0% of that quarter.

d. In the first quarter, \($40,000\) will be borrowed on a promissory note, and equipment costing \($30,000\) will be purchased for cash. In each quarter, dividends of \($10,000\) will be paid in cash. In the fourth quarter, the promissory note plus interest will be paid in cash, \($45,000.\)

Instructions:

Prepare the following budget schedules for the year ended December 31, 20X3. Round percentage amounts to the nearest 0.1%, unit amounts to the nearest 100 units, and dollar amounts to the nearest \($10.\)

a. Prepare a sales budget schedule (Schedule 1).

b. Prepare a purchases budget schedule (Schedule 2).

c. Prepare a selling expenses budget schedule (Schedule 3).

d. Prepare an administrative expenses budget schedule (Schedule 4).

e. Prepare an other revenue and expenses budget schedule (Schedule 5).

f. Prepare a budgeted income statement.

g. Prepare a cash receipts budget schedule (Schedule A).

h. Prepare a cash payments budget schedule (Schedule B).

i. Prepare a cash budget.

Step by Step Answer: