On January 1, 2024, Pearce Company purchased an 80% interest in the capital stock of Searl Company

Question:

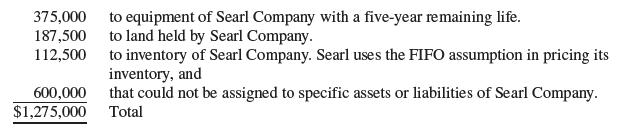

On January 1, 2024, Pearce Company purchased an 80% interest in the capital stock of Searl Company for $2,460,000. At that time, Searl Company had capital stock of $1,500,000 and retained earnings of $300,000. The difference between book of value Searl equity and the value implied by the purchase price was attributed to specific assets of Searl Company as follows:

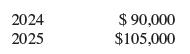

At year- end 2024 and 2025, Searl had in its inventory merchandise that it had purchased from Pearce at a 25% markup on cost during each year in the following amounts:

During 2024, Pearce reported net income from independent operations (including sales to affiliates) of $1,500,000, while Searle reported net income of $600,000. In 2025, Pearce’s net income from independent operations (including sales to affiliates) was $1,800,000 and Searl’s was $750,000.

Required:

Calculate the controlling interest in consolidated net income for 2024 and 2025.

Step by Step Answer: