Manzetti Foods, a U.S. food processing and distribution company, is considering an investment in Germany. You are

Question:

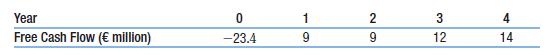

Manzetti Foods, a U.S. food processing and distribution company, is considering an investment in Germany. You are in Manzetti’s corporate finance department and are responsible for deciding whether to undertake the project. The expected free cash flows, in euros, are uncorrelated to the spot exchange rate and are shown here:

The new project has similar dollar risk to Manzetti’s other projects. The company knows that its overall dollar WACC is 10.34%, so it feels comfortable using this WACC for the project. The risk-free interest rate on dollars is 4.14% and the risk-free interest rate on euros is 5.25%. Manzetti is willing to assume that capital markets in the United States and the European Union are internationally integrated. What is the company’s euro WACC?

a. Manzetti is willing to assume that capital markets in the United States and the European Union are internationally integrated. What is the company’s euro WACC?

b. What is the present value of the project in euros?

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9781292437156

5th Global Edition

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford