Turner and Fitting Company is considering the acquisition of Steel and Pipes Enterprises for $2.1 million. Steel

Question:

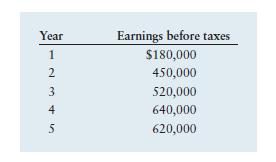

Turner and Fitting Company is considering the acquisition of Steel and Pipes Enterprises for $2.1 million. Steel and Pipes Enterprises has a tax loss carryforward of $1.4 million. Some of the assets are deemed redundant and will be sold at their book value of $1.7 million. The estimated earnings before taxes for the 5 years after the merger are presented in the following table.

All estimated earnings fall within the annual limit that is legally allowed for application of the tax loss carryforward resulting from the merger. The applicable tax rate is 40%.

a. Calculate Turner and Fitting Company’s tax payments and earnings after taxes for each of the next 5 years without the merger.

b. Calculate Turner and Fitting Company’s tax payments and earnings after taxes for each of the next 5 years with the merger.

c. What are the total benefits associated with the tax losses from the merger? (Ignore present value.)

d. Do you recommend the proposed merger? Support your answer with figures.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter