Consider the following information about three stocks: a. If your portfolio is invested 40 percent each in

Question:

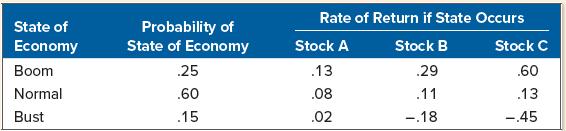

Consider the following information about three stocks:

a. If your portfolio is invested 40 percent each in A and B and 20 percent in C, what is the portfolio expected return? The variance? The standard deviation?

b. If the expected T-bill rate is 3.70 percent, what is the expected risk premium on the portfolio?

c. If the expected inflation rate is 3.30 percent, what are the approximate and exact expected real returns on the portfolio? What are the approximate and exact expected real risk premiums on the portfolio?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9781265553609

13th Edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Question Posted: