Question:

Refer to Table 23.1 in the text to answer this question. Suppose today is September 4, 2001, and your firm is a piping manufacturer that needs 100,000 pounds of copper in March for the upcoming production run. You would like to lock in your costs today, because you’re concerned that copper prices might go up between now and March.

a. How could you use copper futures contracts to hedge your risk exposure? What price would you be effectively locking in?

b. Suppose copper prices are $.76 per pound in March. What is the profit or loss on your futures position? Explain how your futures position has eliminated your exposure to price risk in the copper market.

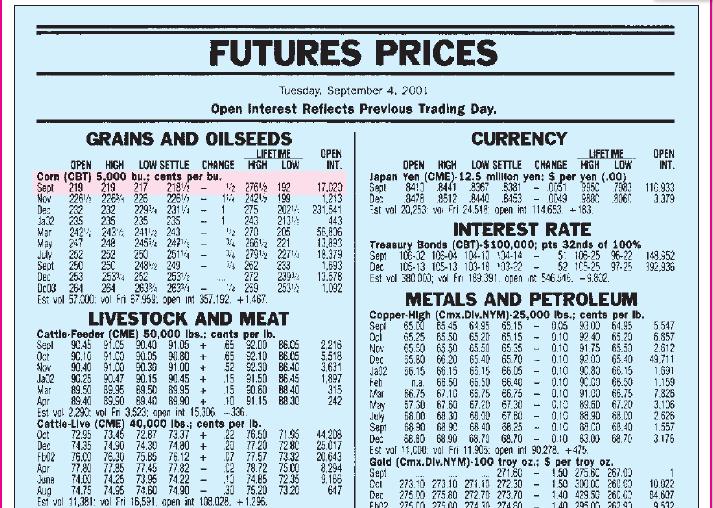

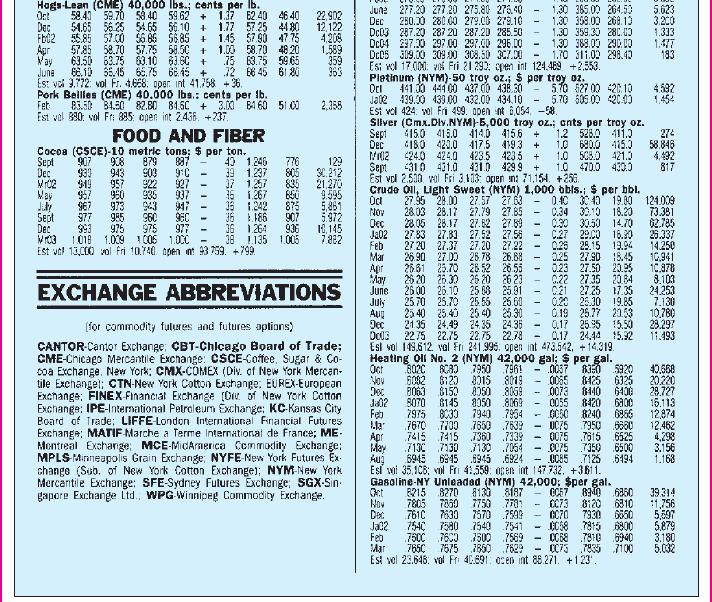

Table 23.1

Transcribed Image Text:

GRAINS AND OILSEEDS

LIFETIME

OPEN HIGH LOW SETTLE CHANGE HIGH LOW

Corn (CBT) 5,000 bu.: cents per bu.

Sept 219 219 217 218

Nov

Dec 232

226 225

226 225 - 1

232 229 231 - 1

1

3332

Mar

May

July

Sept

Dec

235 235

242

243

247 248

252

Sept

Oct

Slow

202

250 250

235 235

2412 243

Oct

Dec

Fb:02

Aar

June

245 247

250

248

252

25114

FUTURES PRICES

Tuesday, September 4, 2001

Open Interest Reflects Previous Trading Day.

249

253

253 253

Dc03 264 264

263% 2634

Est voll 57.000 vol Fri 57.959. open imt 357.192 +1.467.

22762 192 17.020

24215 199 1,213

275 2021 231,541

243

2270

443

213

205 56,806

266¹ 221 13,893

34 2791 22714 18.379

4252 233

272

2391

299 253¹

LIVESTOCK AND MEAT

Cattle-Feeder (CME) 50,000 lbs.: cants per lb.

90.45 91.5 90.40 91.05 + 65

90.10 91.00 90.05 90.80 +

92.00 86.05

65 52.10 B8.05

90.40 91.00 90.30 91.00 + 52 52.30 86.40

90.25 90.47 90.15 90.45 + 15 31.50 86.45

89.50 89.95 89.50 89.95 + 15 50.80 88 40

10 91.15 88 30

Ja2

Mar

Apr

89.40 89.90 89.40 89.90 +

Est val 2290 vol Fri 3.523; apan int 15.306 -336.

Cattle-Live (CME) 40,000 lbs.; cents per lb.

72.95 73.45 72.87 73.37 +

74.35 74.90 74.30 74.80 +

71.95

22 76.50

20 77.20

72 80

C7 77.57 73.32

C2 78.72 75.00

13 74.85 72.35

30

OPEN

INT.

76.00 76.30 75.85 76.12 +

77.80 77.85 77.45 77.82

74.00 74.25 73.95 74.22

Aug

74.75 74.95 74.60 74.90

Est vol 11,381 vel Fri 15,531. open int 108.028. +1.296.

75.20 73 20

1.693

13.578

1,092

2.216

5.518

3.631

1,897

315

242

44.208

25.017

20.643

8.294

9.168

617

CURRENCY

LIFETIME

OPEN HIGH LOW SETTLE CHANGE HIGH LOW

Japan Yen (CME)-12.5 million yen: $ per yen (.00)

Sept

De:

Est val 20,253 vo Fri 24.548 open in 114653 183.

INTEREST RATE

Treasury Bonds (CBT)-$100,000; pts 32nds of 100%

Sept 106-02 103-04 104-13 134-14

Dec

105-13 105-13 103-18 ¹03-22

Est vol 380 000; vol Fri 189.391 open in 546016.-9.802.

Sepi

Ocl

NCA

8413 8441 8367 5381 0061 9950 7983 110.933

8478 8512 8440 8453 0049 9880 8060 3.379

Dec

Ja02

Feb

METALS AND PETROLEUM

Copper-High (Cmx.Div.NYM)-25,000 lbs.; cents per lb.

65.00 65 45 64.95 65.15 0.05 93.00 64.95

65.25 65.50 65.20 65.15 0.10 92 40 65.20

65.50 65 50 65.50 65.35

55.80 66.20 65.40 65.70

56.15 66.15 65.15 66.05

0.10 91.75 65.50

0.10 92.00 65.40

0.10 90.80 66.15

0.10 90.00 66.50

Mar

May

July

n.a. 66.50 65.50 66.40 -

66.75 67.10 65.75 26.75 0.10 91.00 66.75

57.30 67.60 67.20 67.30 - 0.10 83.60 67.20

58.00 68.30 60.00 67.80 - 0.10 3.90 68.00

68.30 68.90 68.40 38.25 0.10 89.00 68.40

68.80 68.90 68.70 68.70 0.10 63.00 68.70

Est val 11,000. val Fri 11.905: open int 90.278. +475

Gold (Cmx.Dlv.NYM)-100 troy oz. $ per troy oz.

271.80

Sept

M

Dec

Sept

1.50 275.6

Cel

273.10 273.10 271.10 272.30

Dec 275.00 275 80 272.70 273.70

27500 275.00 274 30 27450

267.00

1.50 300.00 260.00

1.40 429.50 260.00

Fh02

140 2950 260 97

OPEN

INT.

11

5: 106-25 96-22 148.952

$2 105-25 97-25 392,936

5.547

6.857

2.612

49,711

1.691

1.159

7.826

3.106

2.626

1.557

3176

10.022

84.607

9532