Beagle Beauties is overvalued or undervalued at its current price of around $82? At what price do

Question:

Beagle Beauties is overvalued or undervalued at its current price of around $82? At what price do you feel the stock should sell?

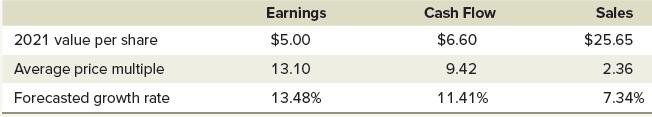

Beagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to make your dog look glamorous. Below you will find selected information necessary to compute some valuation estimates for the firm. Assume the values provided are from year-end 2021. Also assume that the firm’s equity beta is 1.40, the risk-free rate is 2.75 percent, and the market risk premium is 7 percent.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Investments Valuation And Management

ISBN: 9781266824012

10th Edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted: