Chocfix produces hot cocoa mix. The company has two divisions, each operating as a profit center. The

Question:

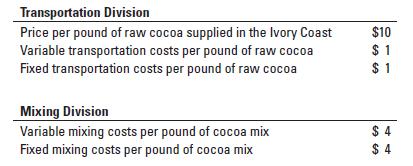

Chocfix produces hot cocoa mix. The company has two divisions, each operating as a profit center. The transportation division purchases raw cocoa in the Ivory Coast and transports it to the mixing division in Atlanta, Georgia. The mixing division processes the raw cocoa into the cocoa mix. It takes two pounds of raw cocoa to yield one pound of cocoa mix. Variable and fixed costs per pound of raw cocoa in the transportation division and variable and fixed costs per pound of cocoa mix in the mixing division area as follows:

Required

1. What are the minimum and maximum transfer prices per pound of raw cocoa transported to the mixing division at which both divisions are willing to transact with each other? Assume the transportation division has unused capacity to transport raw cocoa to the mixing division.

2. Refer to your answer in requirement 1. The management of Chocfix is trying to decide on the specific transfer price within the bounds identified in requirement 1. James Ladell, Chocfix’s CEO, is suggesting to split the difference between the maximum and the minimum transfer price evenly. What is the transfer price under this scenario? What is the contribution margin per pound of raw cocoa for the transportation division? What is the contribution margin per pound of cocoa mix for the mixing division?

3. Leila Brown, Chocfix’s CFO, disagrees with James Ladell’s suggestion to split the difference evenly. She argues that the difference between the maximum and minimum transfer price should be prorated based on the value of the work contributed by each of the divisions to the final product.

a. What is the value of the work contributed by each of the divisions towards a pound of cocoa mix? Ignore fixed costs.

b. What is the transfer price if the difference between the maximum and the minimum transfer price (identified in requirement 1) is prorated based on the relative value of the work contributed by each of the divisions (identified in requirement 3a)? What is the contribution margin per pound of raw cocoa for the transportation division? What is the contribution margin per pound of cocoa mix for the mixing division?

c. Which transfer price, the one identified in requirement 2 or the one identified in requirement 3b, do you think Chocfix should use?

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9780135628478

17th Edition

Authors: Srikant M. Datar, Madhav V. Rajan