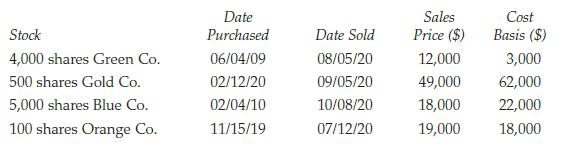

Charu Khanna received a Form 1099-B showing the following stock transactions and basis during 2020: None of

Question:

Charu Khanna received a Form 1099-B showing the following stock transactions and basis during 2020:

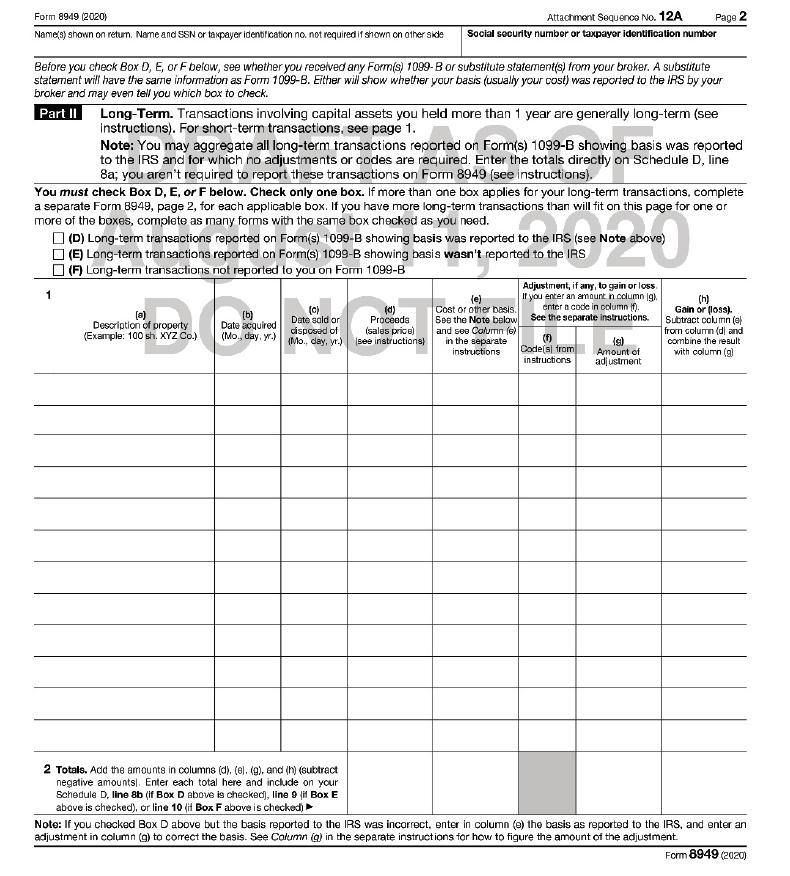

None of the stock is qualified small business stock. The stock basis was reported to the IRS. Calculate Charu’s net capital gain or loss using Schedule D and Form 8949 on Pages 4-53 through 4-56.

Transcribed Image Text:

Stock 4,000 shares Green Co. 500 shares Gold Co. 5,000 shares Blue Co. 100 shares Orange Co. Date Purchased 06/04/09 02/12/20 02/04/10 11/15/19 Date Sold 08/05/20 09/05/20 10/08/20 07/12/20 Sales Price ($) Cost Basis ($) 12,000 3,000 49,000 62,000 18,000 22,000 19,000 18,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

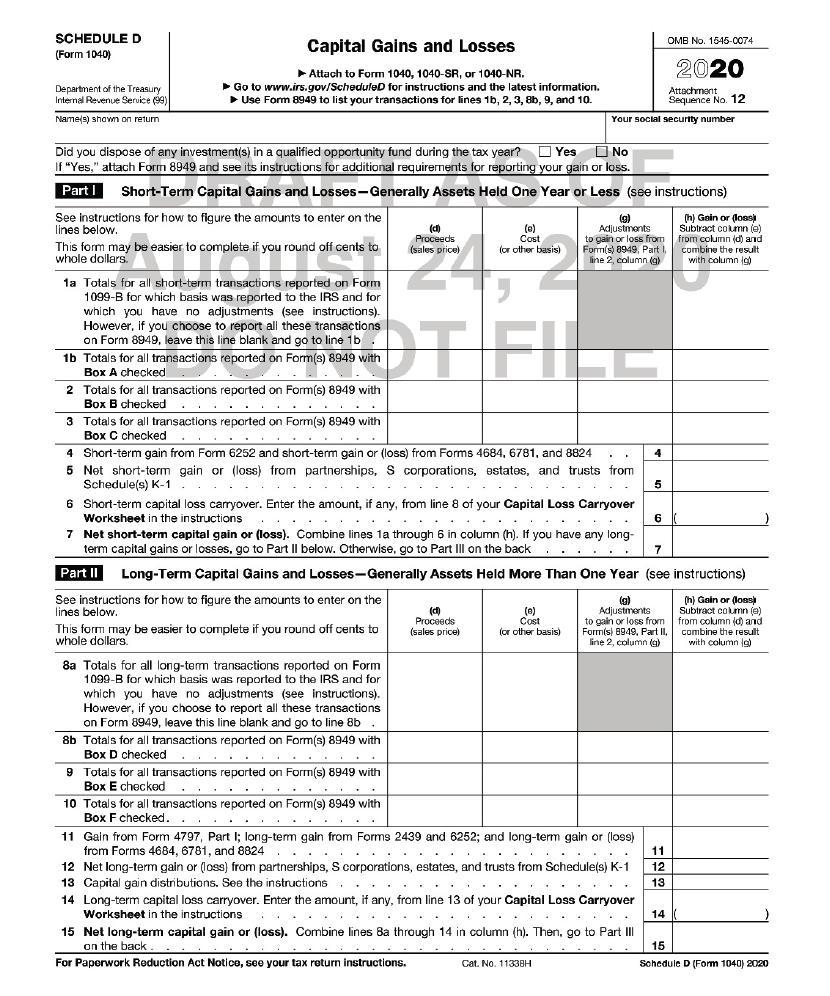

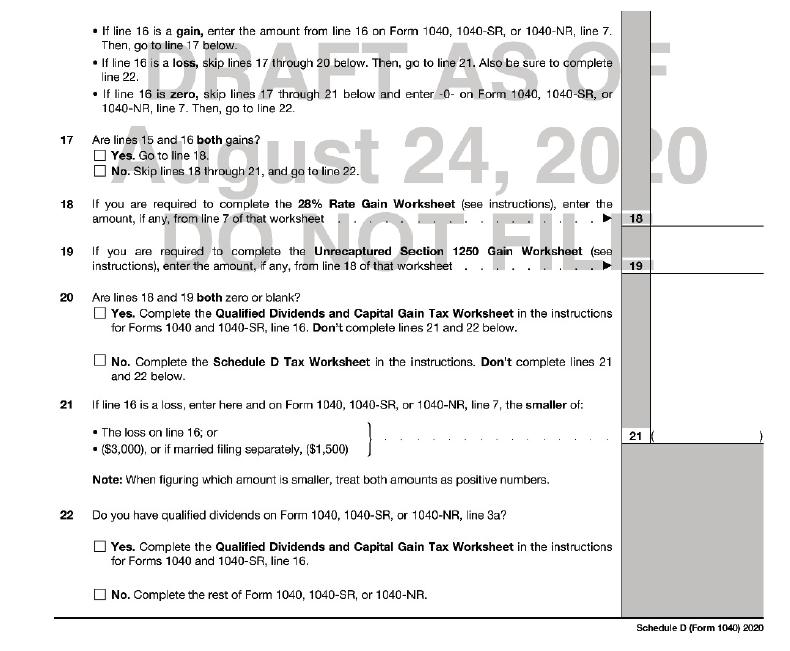

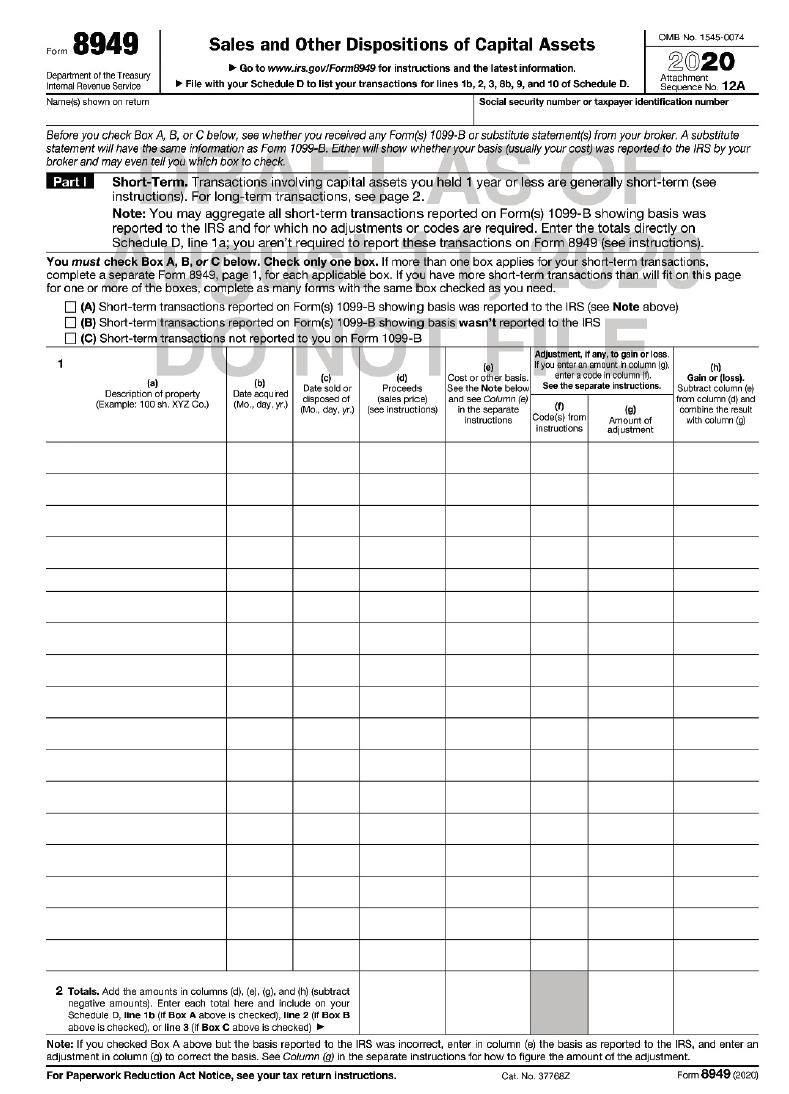

SCHEDULE D Form 1040 Department of the Treasury Internal Revenue Service 99 Names shown on retum Capital Gains and Losses Attach to Form 1040 1040SR or 1040NR Go to wwwirsgovScheduled for instructions ...View the full answer

Answered By

Joseph Mwaura

I have been teaching college students in various subjects for 9 years now. Besides, I have been tutoring online with several tutoring companies from 2010 to date. The 9 years of experience as a tutor has enabled me to develop multiple tutoring skills and see thousands of students excel in their education and in life after school which gives me much pleasure. I have assisted students in essay writing and in doing academic research and this has helped me be well versed with the various writing styles such as APA, MLA, Chicago/ Turabian, Harvard. I am always ready to handle work at any hour and in any way as students specify. In my tutoring journey, excellence has always been my guiding standard.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Charu Khanna received a Form 1099-B showing the following stock transactions and basis during 2016: None of the stock is qualified small business stock. The stock basis was reported to the IRS....

-

Charu Khanna received a Form 1099-B showing the following stock transactions and basis during 2018: None of the stock is qualified small business stock. The stock basis was reported to the IRS....

-

Karim Depak received a Form 1099-B showing the following stock transactions and basis during 2014: None of the stock is qualified small business stock. Calculate Karim's net capital gain or loss...

-

In Exercises 1318, find the average rate of change of the function from x 1 to x 2 . f(x)=x from x = 4 to x = 9

-

What role does middleware play?

-

1. Summarize the results of John's analysis in one paragraph that a manager, not a forecaster, can understand. 2. Describe the trend and seasonal effects that appear to be present in the sales data...

-

Calculate the mean for each of the following sets of data: a. 1, 1, 2, 3, 3 b. 1, 4, 4, 5, 6, 7, 8 c. 47, 56, 62, 69, 70, 73 d. .75, .23, .48, .60, .98, .65, .08, .12., .39 e. 11.02, 13.67, 17.39,...

-

Nazari Electrical Services has an August 31 fiscal year end. The company's trial balance prior to adjustments follows: Additional information: 1. The equipment has an expected useful life of 12...

-

what ways does inspiration intersect with motivation and drive, propelling individuals towards extraordinary feats of accomplishment ? Explain

-

Skylar and Walter Black have been married for 25 years. They live at 883 Scrub Brush Street, Apt. 52B, Las Vegas, NV 89125. Skylar is a stay-at-home parent and Walt is a high school teacher. Skylars...

-

Heather drives her minivan 903 miles for business purposes in 2020. She elects to use the standard mileage rate for her auto expense deduction. Her deduction will be a. $510 b. $515 c. $519 d. $553...

-

Why do control transfers, especially conditional control transfers, cause problems for an instruction-pipelined machine? Explain the nature of these problems and discuss some of the techniques that...

-

Our most rapid job growth was in the period from _____. a) 2000 to 2005 b) 1995 to 2000 c) 1978 to 1983 d) 1953 to 1958

-

The law of increasing costs is explained by each of the following except __________. a) the law of diminishing returns b) diseconomies of scale c) factor suitability d) overspecialization

-

Which of the following would be the most accurate description of our economy since the end of 2007? a) We have had virtually no economic problems. b) We experienced the worst economic mess since the...

-

What is diversification? Does a stockholder get a greater benefit from diversification when going from 1 to 10 stocks or when going from 100 to 120 stocks?

-

As we produce increasing amounts of a particular good, the resources used in its production ________. a) become more suitable b) become less suitable c) continue to have the same suitability

-

The four stocks listed in the text are part of an index. Using the prior information, a. Compute a price-weighted index by adding the stocks' prices at time t and time t + 1. What is the percentage...

-

Fill in each blank so that the resulting statement is true. 83 + 103 = ______ .

-

Teresa is a civil engineer who uses her automobile for business. Teresa drove her automobile a total of 11,965 miles during 2018, of which 80 percent was business mileage. The actual cost of...

-

Heather drives her minivan 953 miles for business purposes in 2018. She elects to use the standard mileage rate for her auto expense deduction. Her deduction will be a. $510 b. $515 c. $519 d. $181...

-

Joan is a self-employed attorney in New York City. Joan took a trip to San Diego, CA, primarily for business, to consult with a client and take a short vacation. On the trip, Joan incurred the...

-

1.What is Brand Management? 2.Importance of Brand Management? 3.What are the types of Brand Management?

-

Write (must type). all the differences discussed/provided in chapter 1 for manufacturing industry and construction industry. List the differences side-by-side for both industries. You can create a...

-

For the compound interest loan whose terms are given below, find the future value, or the amount due at the end of the specified time. Principal: $6800 Interest rate: 3.8% Compounding: Monthly Time:...

Study smarter with the SolutionInn App