Skylar and Walter Black have been married for 25 years. They live at 883 Scrub Brush Street,

Question:

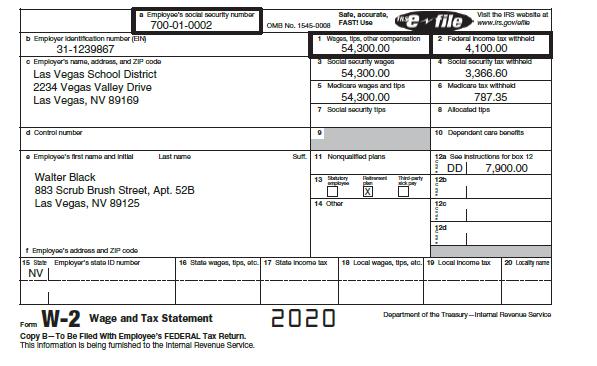

Skylar and Walter Black have been married for 25 years. They live at 883 Scrub Brush Street, Apt. 52B, Las Vegas, NV 89125. Skylar is a stay-at-home parent and Walt is a high school teacher. Skylar’s Social Security number is 222-43-7690 and Walt’s is 700-01-0002. Neither are age 65 or older. The Blacks provide all the support for Skylar’s mother, Rebecca Backin (Social Security number 411-66-2121), who lives in a nursing home in Reno, NV and has no income. Walter’s father, Alton Black (Social Security number 343-22-8899), lives with the Blacks in Las Vegas. Although Alton received Social Security benefits of $7,600 in 2020, the Blacks provide over half of Alton’s support. Skylar and Walt claim a $500 other dependent credit each for Rebecca and Alton. Walt’s earnings from teaching are:

The Blacks moved from Maine to Nevada. As a result, they sold their house in Maine on January 4, 2020. They originally paid $75,000 for the home on July 3, 1995, but managed to sell it for $604,000. They spent $14,000 on improvements over the years. They are currently renting in Las Vegas while they look for a new home.

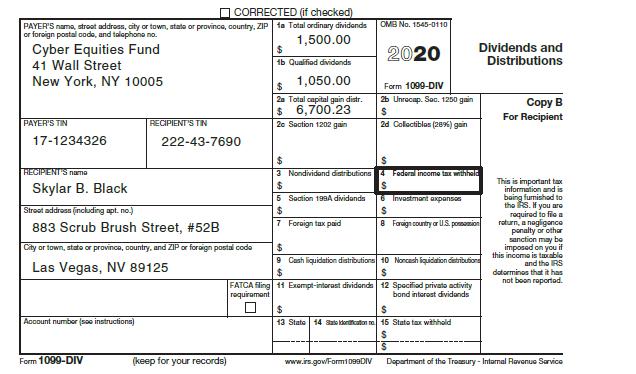

The Blacks received the following 1099-DIV from their mutual fund investments:

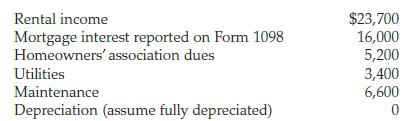

The Blacks own a ski condo located at 123 Buncombe Lane, Brian Head, UT 84719. The condo was rented for 185 days during 2020 and used by the Blacks for 15 days. The rental activity does not rise to the level to qualify for the QBI deduction. Pertinent information about the condo rental is as follows:

The above amounts do not reflect any allocation between rental and personal use of the condo. The Blacks are active managers of the condo.

The Blacks received a $2,400 EIP in 2020.

Required:

Complete the Black’s federal tax return for 2020. Use Form 1040, Schedule 1, Schedule D, Form 8949, Schedule E (page 1 only), Form 8582 (page 1 only) and the Qualified Dividends and Capital Gain Tax Worksheet to complete their tax return.

Step by Step Answer:

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill