During 2020, Pepe Guardio purchases the following property for use in his calendar year-end manufacturing business: Pepe

Question:

During 2020, Pepe Guardio purchases the following property for use in his calendar year-end manufacturing business:

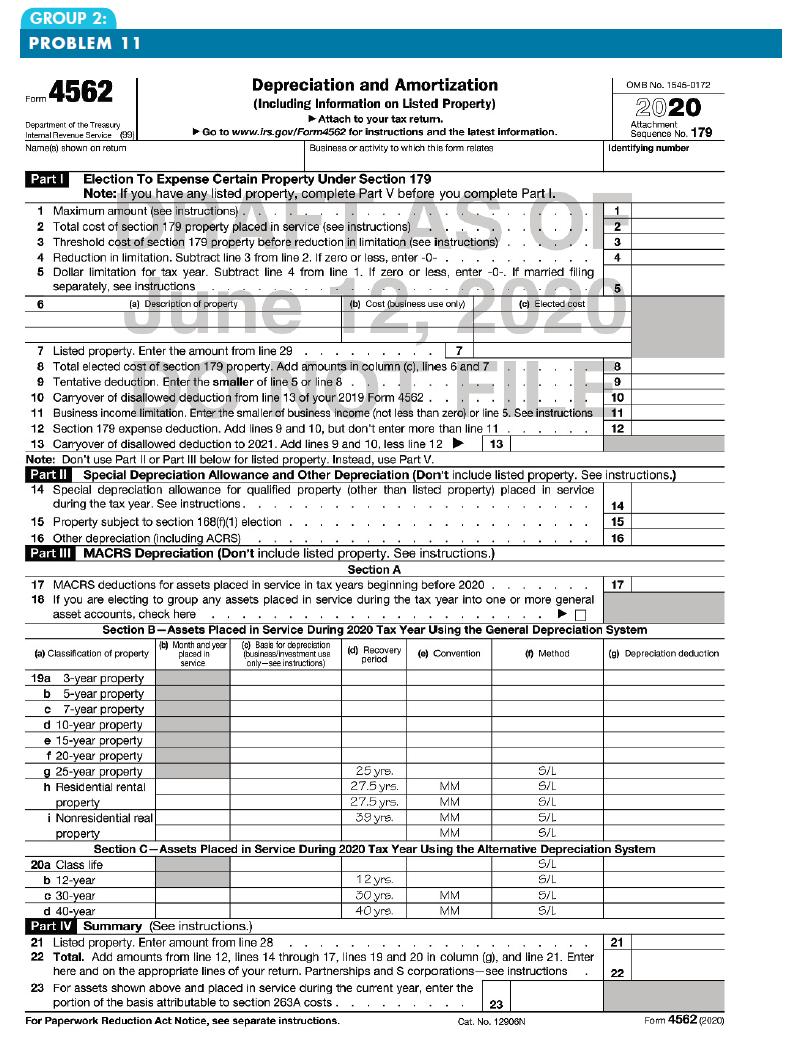

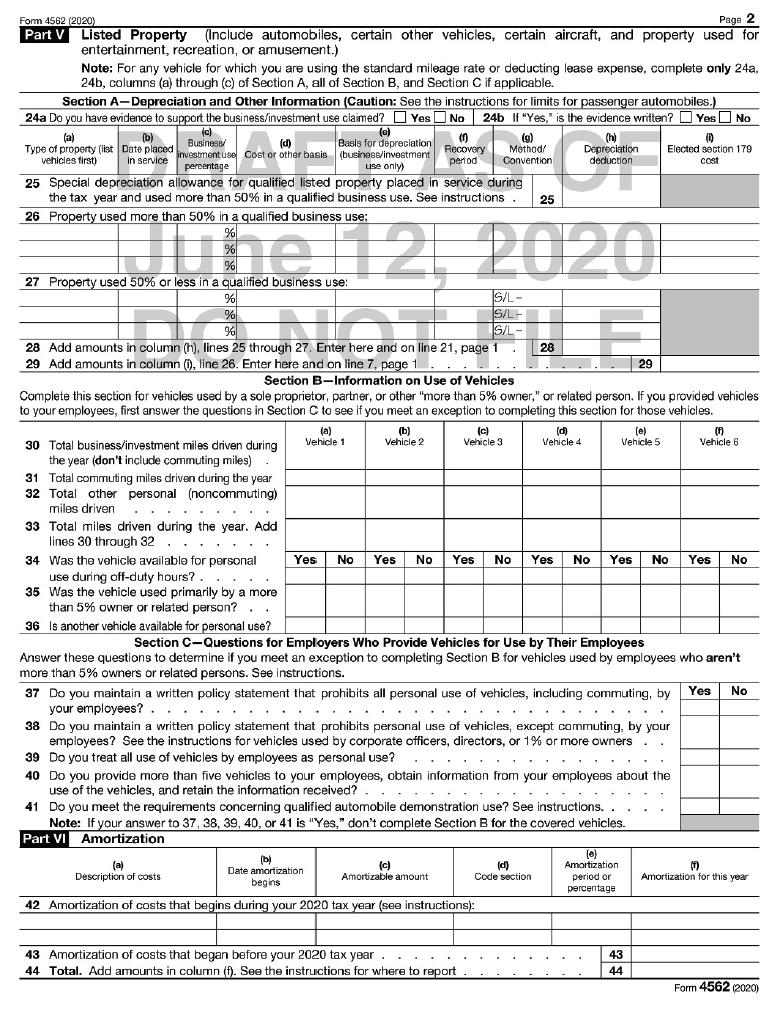

Pepe uses the accelerated depreciation method under MACRS, if available, and does not make the election to expense and elects out of bonus depreciation. Use Form 4562 on Pages 8-43 and 8-44 to report Pepe’s depreciation expense for 2020.

Transcribed Image Text:

Item Manufacturing equipment (7 year) Office furniture Office computer Passenger automobile (used 85 percent for business) Warehouse Building Land Date Acquired June 2 September 15 November 18 May 31 July 23 Cost $50,000 8,000 2,000 55,000 170,000 135,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (5 reviews)

See Form 4562 on pages 85 and 86 Convention test 4th quarter 2000 total personal property 106750 note auto at 85 2 thus halfyear convention Auto depreciation 55000 x 85 x 20 9350 but limited to 10100 ...View the full answer

Answered By

Somshukla Chakraborty

I have a teaching experience of more than 4 years by now in diverse subjects like History,Geography,Political Science,Sociology,Business Enterprise,Economics,Environmental Management etc.I teach students from classes 9-12 and undergraduate students.I boards I handle are IB,IGCSE, state boards,ICSE, CBSE.I am passionate about teaching.Full satisfaction of the students is my main goal.

I have completed my graduation and master's in history from Jadavpur University Kolkata,India in 2012 and I have completed my B.Ed from the same University in 2013. I have taught in a reputed school of Kolkata (subjects-History,Geography,Civics,Political Science) from 2014-2016.I worked as a guest lecturer of history in a college of Kolkata for 2 years teaching students of 1st ,2nd and 3rd year. I taught Ancient and Modern Indian history there.I have taught in another school in Mohali,Punjab teaching students from classes 9-12.Presently I am working as an online tutor with concept tutors,Bangalore,India(Carve Niche Pvt.Ltd.) for the last 1year and also have been appointed as an online history tutor by Course Hero(California,U.S) and Vidyalai.com(Chennai,India).

4.00+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

During 2019, Pepe Guardio purchases the following property for use in his calendar year-end manufacturing business: Item Date Acquired Cost Manufacturing equipment (7 year) June 2 $40,000 Office...

-

During 2014, Palo Fiero purchases the following property for use in his calendar year-end manufacturing business: Palo uses the accelerated depreciation method under MACRS, if available, and does not...

-

During 2015, Palo Fiero purchases the following property for use in his calendar year-end manufacturing business: Item Date Acquired Cost Manufacturing equipment ............ June 2...

-

Pacific Company sells electronic test equipment that it acquires from a foreign source. During the year 2014, the inventory records reflected the following: Inventory is valued at cost using the LIFO...

-

Dutch, Bill, and Heidi were equal partners in a lawn care business. Bill and Heidi wanted to borrow money from the bank to buy more trucks and expand the business. Dutch was dead set against the...

-

How research is conducted, including the cycle of induction and deduction, as well as the five steps involved in the process

-

How do you think the shift of economic activity to emerging regions affects growth in advanced economies? Discuss if a reverse shift of activity is possible. LO.1

-

Calvin uses fraud to induce Maria to promise to pay money in return for goods he has delivered to her. Has a contract been formed? If so, what kind? What are the rights of Calvin and Maria?

-

Darcy Roofing is faced with a decision. The company relies very heavily on the use of its 60-foot extension lift for work on large homes and commercial properties. Last year, Darcy Roofing spent $...

-

Complete the entire pay cycle process by calculating gross to net pay, employer premium amounts and complete required accounting entries. Sandra works in British Columbia and is paid on a...

-

Nadia Shalom has the following transactions during the year: Sale of office equipment on March 15 that cost $21,500 when purchased on July 1, 2018. Nadia has claimed $21,500 in depreciation and sells...

-

Calculate the following: a. The first year of depreciation on a residential rental building that cost $250,000 purchased June 2, 2020. b. The second year (2021) of depreciation on a computer that...

-

Under what circumstances does a monopoly set its price equal to its marginal cost?

-

Choose a private label product that you have seen and discuss the possible reasons for why the particular retailer introduced this private label product and explain its features in detail.

-

Understanding your behaviors can help you become a better leader. As discussed in module 4 our beliefs & values can be summed up as our 'personality'. In this assignment you are to examine your own...

-

This week we learned about assessing competition. Watch the video the History of the Cola Wars and answer the following questions. Using the frameworks from the text and the online lesson, why is...

-

Prior to developing your training programs, you must analyze your organizational military needs, identify employee skills gaps based on performance, and have resources available to support training...

-

Describe specifically how your firm's culture lines up with the bullet points listed for that firm . For instance, if you believe your organization's strategy priority is creativity-driven , then...

-

Frank, age 28, wants to calculate his resources in real (inflation-adjusted) terms. Calculate the amount of resources made available by age 65 retirement if $18,000 a year is saved. Assume that...

-

Differentiate. y = ln(3x + 1) ln(5x + 1)

-

Jane graduates from high school in June 2016. In the fall, she enrolls for twelve units at Big State University. Big State University considers students who take twelve or more units to be full-time....

-

In September 2016, Sam pays $2,200 to take a course to improve his job skills to qualify for a new position at work. Assuming there is no phase-out of the credit, his lifetime learning credit for...

-

In November 2016, Simon pays $6,200 to take a course to improve his job skills to qualify for a new position at work. Simons employer reimbursed him for the cost of the course. For 2016, Simons...

-

Chapter o Homew ebook 50,000-unit production quantity: $ 227,049 7 70,000-unit production quantity: $ 66,751 d. In addition to mean profit, what other factors should FTC consider in determining a...

-

Diamond makes downhill ski equipment. Assume that comic has offered to produce ski poles for Diamond for $20 per pair Diamond needs 200,000 pairs of poles per period Diamond can only avoid 5150,000...

-

17? Which of the following statement is true Select one: a. All evidence must have the same level of reliability b. All evidence must have the same level of persuasiveness C. All are false d....

Study smarter with the SolutionInn App