Nadia Shalom has the following transactions during the year: Sale of office equipment on March 15 that

Question:

Nadia Shalom has the following transactions during the year:

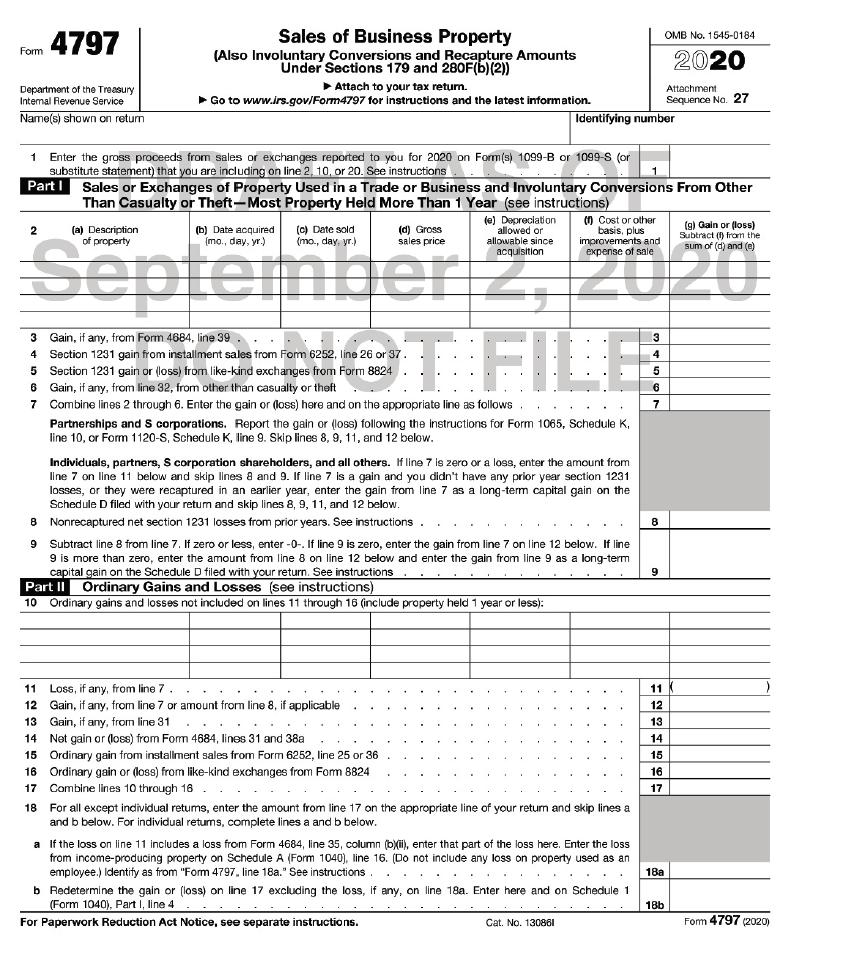

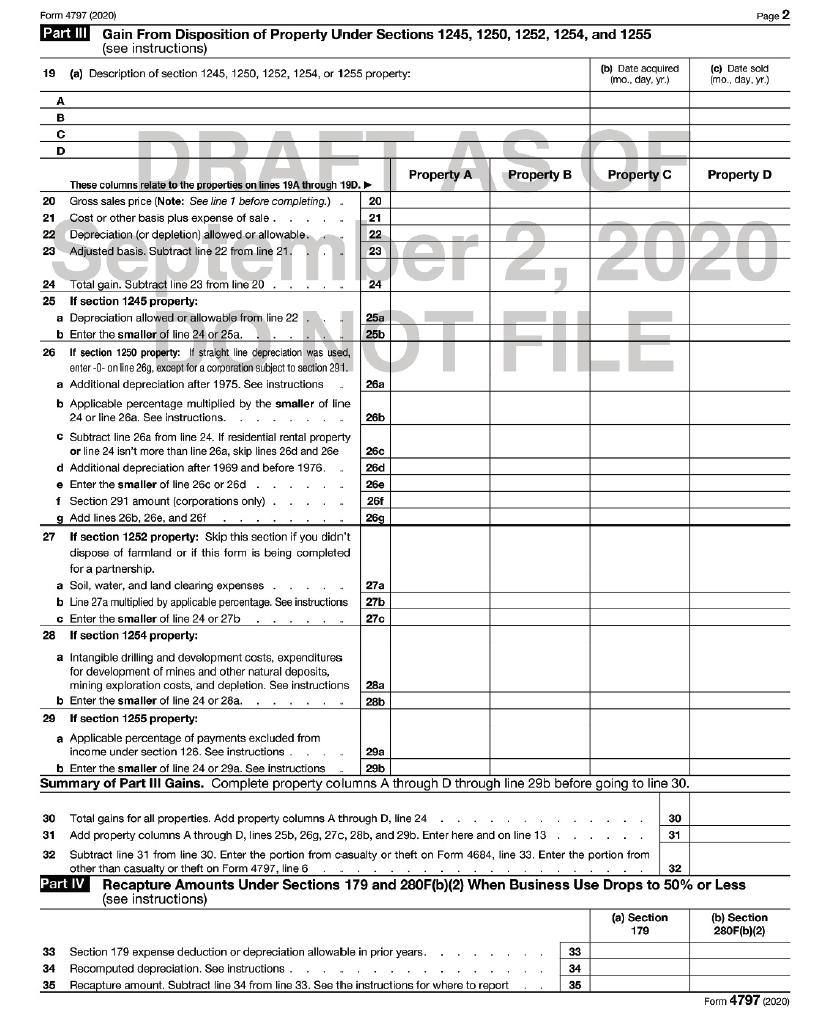

Sale of office equipment on March 15 that cost $21,500 when purchased on July 1, 2018. Nadia has claimed $21,500 in depreciation and sells the asset for $13,500 with no selling costs.

Sale of land on April 19 for $125,000. The land cost $132,500 when purchased on February 1, 2009. Nadia’s selling costs are $6,500.

Assume there were no capital improvements on either business asset sold. Nadia’s Social Security number is 924-56-5783. Complete Form 4797 on Pages 8-45 and 8-46 to report the above gains or losses.

Transcribed Image Text:

4797 Department of the Treasury Internal Revenue Service Name(s) shown on return Form 2 Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Attach to your tax return. Go to www.irs.gov/Form4797 for instructions and the latest information. (a) Description of property 1 Enter the gross proceeds from sales or exchanges reported to you for 2020 on Form(s) 1099-B or 1099-S (or substitute statement) that you are including on line 2, 10, or 20. See instructions Part I Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft-Most Property Held More Than 1 Year (see instructions) (e) Depreciation allowed or allowable since acquisition 2 FILE Partnerships and S corporations. Report the gain or (loss) following the instructions for Form 1065, Schedule K, line 10, or Form 1120-S, Schedule K, line 9. Skip lines 8, 9, 11, and 12 below. (b) Date acquired (mo., day, yr.) (c) Date sold (mo., day, yr.) 3 Gain, if any, from Form 4684, line 39. 4 Section 1231 gain from installment sales from For 6252, line 26 or 37. 5 Section 1231 gain or (loss) from like-kind exchanges from Form 8824 6 Gain, if any, from line 32, from other than casualty or theft 7 Combine lines 2 through 6. Enter the gain or (loss) here and on the appropriate line as follows (d) Gross sales price 11 Loss, if any, from line 7. 12 Gain, if any, from line 7 or amount from line 8, if applicable 13 Gain, if any, from line 31 iduals, partners, S corporation shareholders, I all others. If line 7 is zero a loss, enter the amount t line 7 on line 11 below and skip lines 8 and 9. If line 7 is a gain and you didn't have any prior year section 1231 losses, or they were recaptured in an earlier year, enter the gain from line 7 as a long-term capital gain on the Schedule D filed with your retum and skip lines 8, 9, 11, and 12 below. Nonrecaptured net section 1231 losses from prior years. See instructions ....*** 14 Net gain or (loss) from Form 4684, lines 31 and 38a 15 Ordinary gain from installment sales from Form 6252, line 25 or 36 16 Ordinary gain or (loss) from like-kind exchanges from Form 8824 17 Combine lines 10 through 16.. 18 Identifying number 8 9 Subtract line 8 from line 7. If zero or less, enter -0-. If line 9 is zero, enter the gain from line 7 on line 12 below. If line 9 is more than zero, enter the amount from line 8 on line 12 below and enter the gain from line 9 as a long-term capital gain on the Schedule D filed with your return. See instructions Part II Ordinary Gains and Losses (see instructions) 10 Ordinary gains and losses not included on lines 11 through 16 (include property held 1 year or less): (Cost or other basis, plus improvements and expense of sale For all except individual retums, enter the amount from line 17 on the appropriate line of your return and skip lines a and b below. For individual retums, complete lines a and b below. a If the loss on line 11 includes a loss from Form 4684, line 35, column (b)(ii), enter that part of the loss here. Enter the loss from income-producing property on Schedule A (Form 1040), line 16. (Do not include any loss on property used as an employee.) Identify as from "Form 4797, line 18a." See instructions Cat. No. 130861 1 b Redetermine the gain or (loss) on line 17 excluding the loss, if any, on line 18a. Enter here and on Schedule 1 (Form 1040), Part I, line 4 For Paperwork Reduction Act Notice, see separate instructions. 3 7 8 9 11 12 13 14 15 16 17 OMB No. 1545-0184 2020 18a Attachment. Sequence No. 27 18b (g) Gain or (loss) Subtract (f) from the sum of (d) and (e) Form 4797 (2020)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

4797 Department of the Treasury Internal Revenue Service Names shown on return Form 2 Sales of Business Property Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280Fb2 Identi...View the full answer

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Nadia Shalom has the following transactions during the year: Sale of office equipment on March 15 that cost $19,000 when purchased on July 1, 2016. Nadia has claimed $3,000 in depreciation and sells...

-

Nadia Shalom has the following transactions during the year: Sale of office equipment on March 15 that cost $19,000 when purchased on July 1, 2014. Nadia has claimed $3,000 in depreciation and sells...

-

Frank Willingham has the following transactions during the year: Sale of office equipment on March 15 that cost $20,000 when purchased on July 1, 2010. Frank has claimed $5,000 in depreciation and...

-

The figure shows a coil with a sheet iron core with unlimited magnetic penetration and a rectangular cross-section. The coil is made of insulated copper wire with specific resistance p. Coil...

-

Carrie and Laura started a business together to sell bridesmaid dresses online. Carrie spent months preparing the financials and meeting with potential investors while Laura designed dresses and...

-

Explain why spell checkers and style checkers do not replace proofreading.

-

The HARA (for hyperbolic absolute risk aversion) class of utility functions is defined by \[U(x)=\frac{1-\gamma}{\gamma}\left(\frac{a x}{1-\gamma}+b ight)^{\gamma}, \quad b>0\] The functions are...

-

What accounting constraint is illustrated by the items below? (a) Grecos Farms, Inc. reports agricultural crops on its balance sheet at fair value. (b) Rafael Corporation discloses fair value...

-

Prepare adjusting entries as of December 3 1 of the current year for the following transactions. Note: If no entry is required for a transaction / event , select " No journal entry required" in the...

-

Michele is single with no dependents and earns $32,000 this year. Michele claims exempt on her Form W-4. Which of the following is correct concerning her Form W-4? a. Michele may not under any...

-

During 2020, Pepe Guardio purchases the following property for use in his calendar year-end manufacturing business: Pepe uses the accelerated depreciation method under MACRS, if available, and does...

-

Smith Computer Center currently has a $13,095.00 balance in Accounts Receivable. Here is a current schedule of Accounts Receivable: Assignment Although the All Star Sports, Inc. account is not 90...

-

What are some advantages and disadvantages of short-term versus long-term debt?

-

Why is cash management important?

-

Why is the compressed adjusted present value approach appropriate for situations with a changing capital structure?

-

Explain how a new firms receivables balance is built up over time.

-

How would a shift from a tight credit policy to a relaxed policy be likely to affect a firms cash budget?

-

Michael Paul wants to start his own business when he graduates from college in three years and he needs $ 600,000 to do so. How much money must he put aside today under the following conditions? A....

-

Find the equations of the ellipses satisfying the given conditions. The center of each is at the origin. Passes through (2, 2) and (1, 4)

-

Taxpayers without minimum essential coverage for part of the year that are not eligible for an exemption must a. Purchase double health insurance for the following tax year b. Buy a catastrophic...

-

For purposes of determining shared responsibility, household AGI is a. AGI for the taxpayer and spouse b. AGI for the taxpayer, spouse and any other household members required to file a tax return c....

-

The American Opportunity tax credit is 100 percent of the first of tuition and fees paid and 25 percent of the next . a. $600; $1,200 b. $1,100; $550 c. $2,000; $2,000 d. $1,100; $5,500 e. None of...

-

Interpersonal conflicts are starting to develop on a project. What is the best communication method to use when confronting the problem?

-

With a major storm approaching, a construction project still has work teams out in the field. The weather service has indicated that everyone should take precautions immediately. What is the best...

-

During the pandemic, the use of telemedicine for primary care visits has significantly increased. From a patient's standpoint, how does telemedicine affect the demand for primary care visits? Think...

Study smarter with the SolutionInn App