Noah and Joan Arc live with their family at 4342 Josie Jo, Santee, CA 92071. Noahs Social

Question:

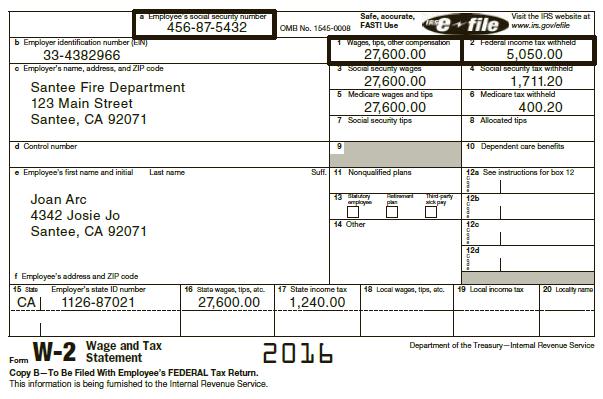

Noah and Joan Arc live with their family at 4342 Josie Jo, Santee, CA 92071. Noah’s Social Security number is 434-11-3311; Joan’s is 456-87-5432. Both are in their mid-30s and enjoy good health and eyesight. Noah owns and operates a pet store and Joan is a fire-fighter for the city.

1. The Arcs have two children, a son named Billie Bob (Social Security number 598-01- 2345), who is 7 years old, and a daughter named Mary Sue (Social Security number 554-33-2411), who is 4 years old. The Arcs paid $3,200 to the Roundup Day Care Center to take care of Mary Sue while they worked. Because Joan is a firefighter, she was home in the afternoon to care for Billie Bob after school.

2. For the current year, Joan’s W-2 from the city fire department is located on Page D-4. Noah made estimated federal income tax payments of $12,000 and estimated state income tax payments of $1,020 during the current year.

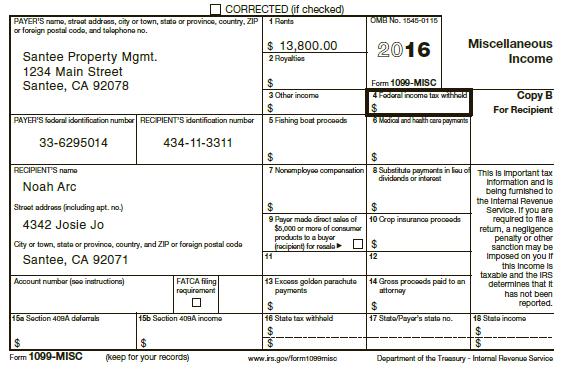

3. Noah’s pet store is located at 18542 Mission Road, Santee, CA 92071. The name of the store is ‘‘The Arc,’’ and its taxpayer ID number is 95-9876556. The beginning inventories and ending inventories are both $10,000. The revenue and expenses for the year are as follows:

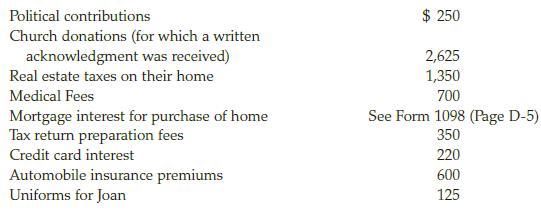

4. Noah and Joan paid the following amounts during the year (all by check):

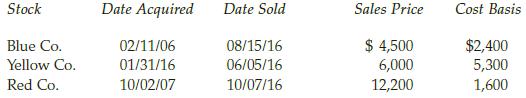

5. Noah likes to invest in the stock market. His Form 1099-B showed the following information for Noah’s stock sales:

The expenses of sale are included in the cost basis. Noah has a long-term capital loss carryover from last year of $2,350.

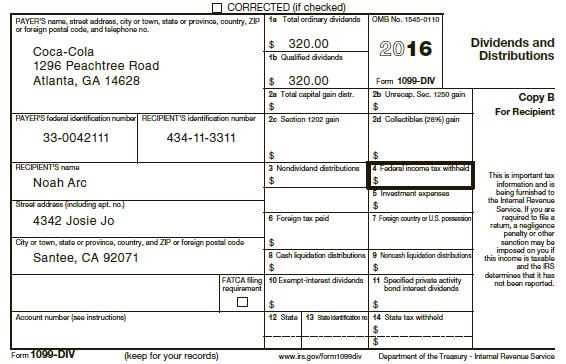

6. During the year, Noah and Joan received the following qualifying dividends:

All stocks, bonds, and savings accounts were purchased or established with community property.

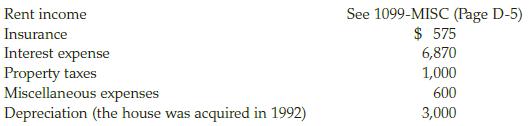

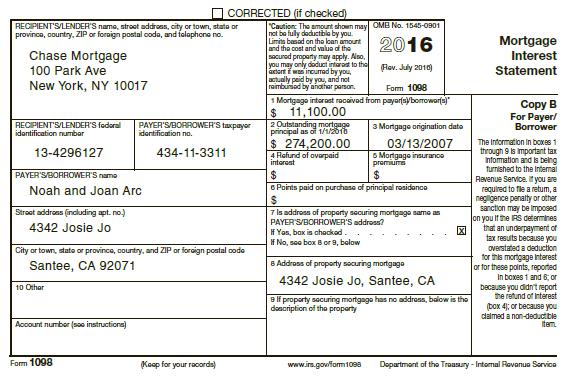

7. Noah and Joan own rental property located at 6431 Gary Ct., San Diego, CA 92115. The revenue and expenses for the year are as follows:

8. All members of the Arc household were covered for the entire year under health care insurance through Joan’s employer.

9. The Arcs paid California general sales tax of $976 during the year.

Required: Although Noah and Joan do not believe their tax return will be unduly complicated, they do realize their limitations and come to you for assistance. You are to prepare their federal income tax return in good form, signing the return as the preparer. Do not complete a California state income tax return. Noah and Joan have completed a tax organizer and have also given you several IRS forms (see Pages D-4 and D-5) that they were not sure what to do with. Make realistic assumptions about any missing data (addresses, etc.) that you may need. The following forms and schedules are required:

Step by Step Answer:

Income Tax Fundamentals 2017

ISBN: 9781305872738

35th Edition

Authors: Gerald E. Whittenburg, Steven Gill, Martha Altus Buller