Sherry Hopson owns a retail family clothing store. Her store is located at 4321 Heather Drive, Henderson,

Question:

Sherry Hopson owns a retail family clothing store. Her store is located at 4321 Heather Drive, Henderson, NV 89002. Her employer identification number is 95 1234321 and her Social Security number is 123456789. Sherry keeps her books on an accrual basis. The income and expenses for the year are:

Gross sales..................$351,700

Returns and allowances..................4,000

Expenses:

Beginning inventory (at cost)..................$ 84,300

Add: purchases..................100,700

Cost of goods available for sale..................185,000

Less: ending inventory (at cost)..................75,000

Cost of goods sold..................$110,000

Rent..................23,800

Insurance..................1,500

Legal and accounting fees..................2,800

Payroll..................37,200

Payroll taxes..................3,440

Utilities..................1,850

Office supplies..................750

Advertising..................2,100

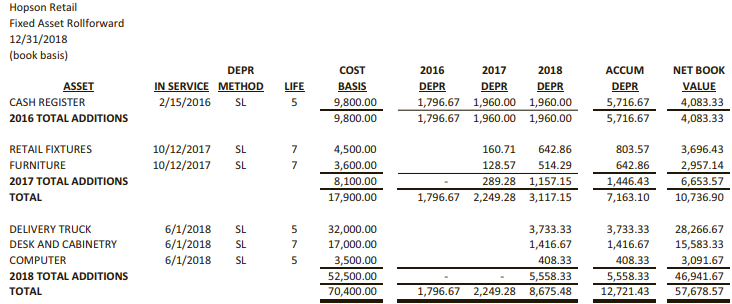

Sherry’s bookkeeper has provided the following book-basis fixed asset roll forward:

The truck is not considered a passenger automobile for purposes of the luxury automobile limitations. Required: For tax purposes, Sherry elected out of bonus depreciation in all years except 2018. She did not elect immediate expensing in any year. The tax lives of the assets are the same as the book lives shown in the fixed asset schedule above. Complete Sherry’s Schedule C and Form 4562. Make realistic assumptions about any missing data.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill