The following information is available for the Albert and Allison Gaytor family in addition to that provided

Question:

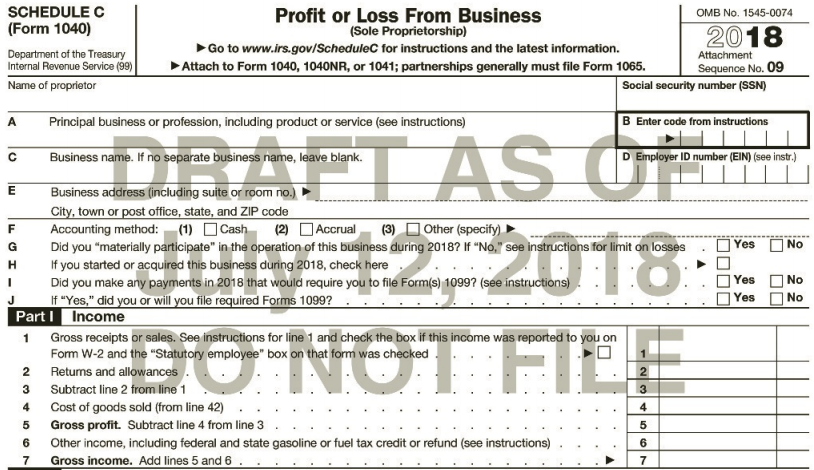

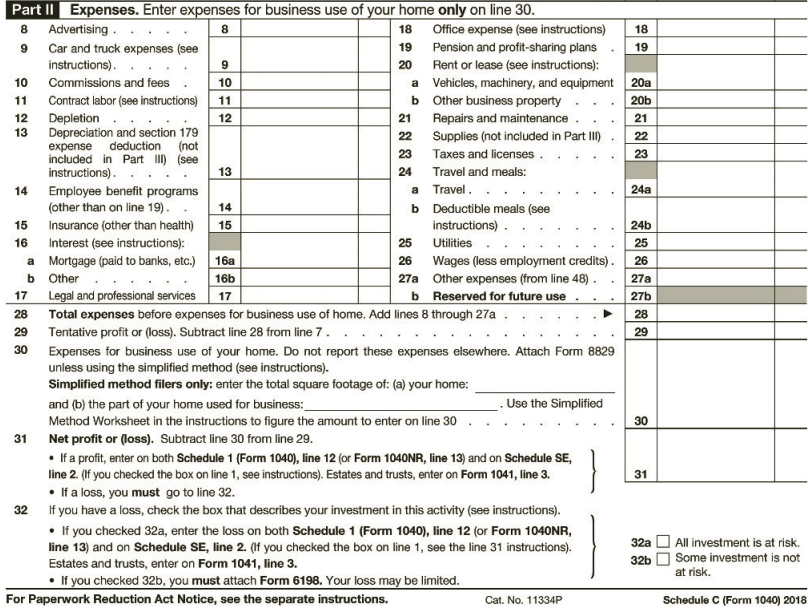

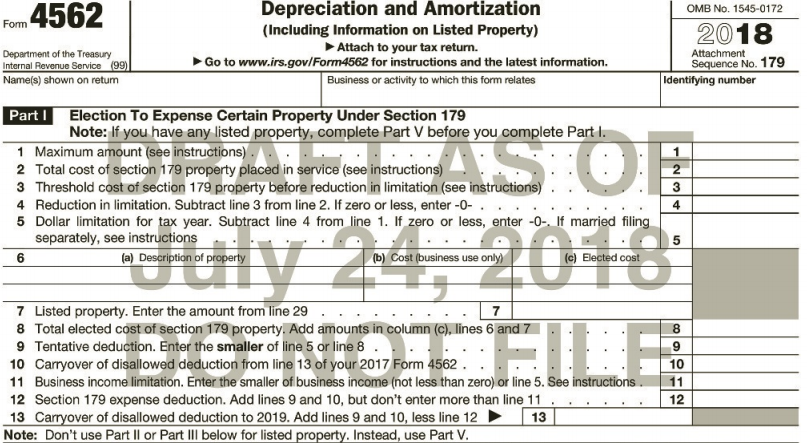

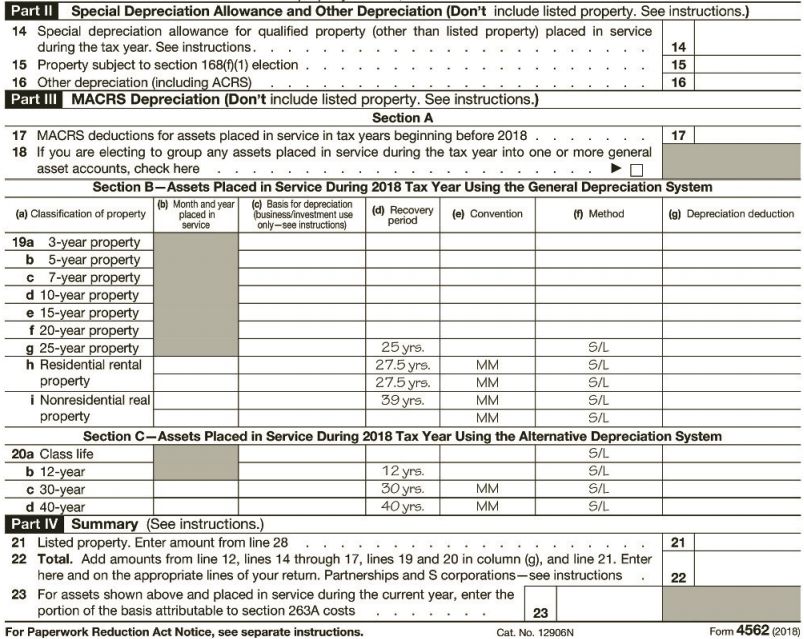

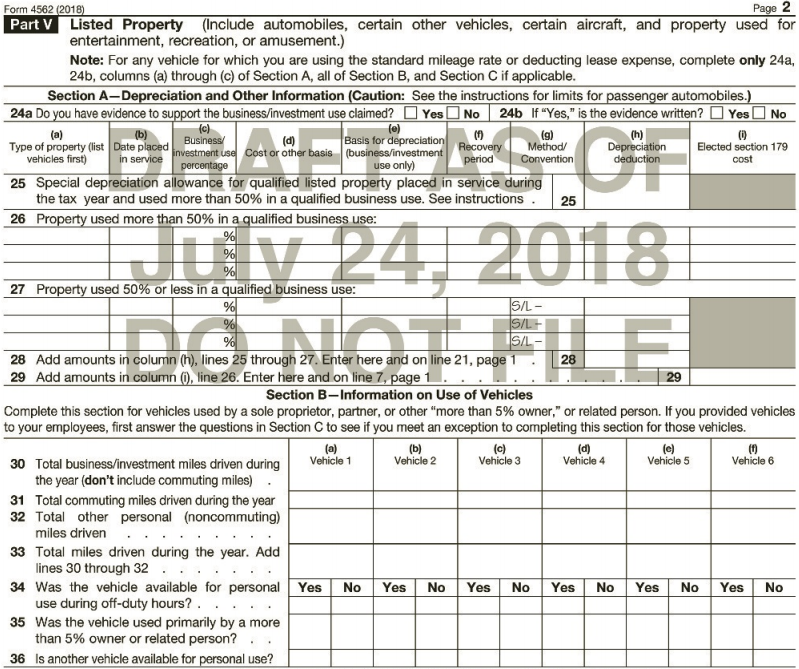

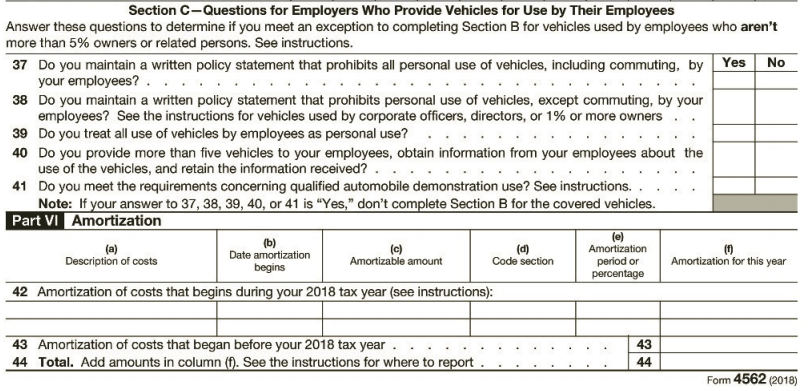

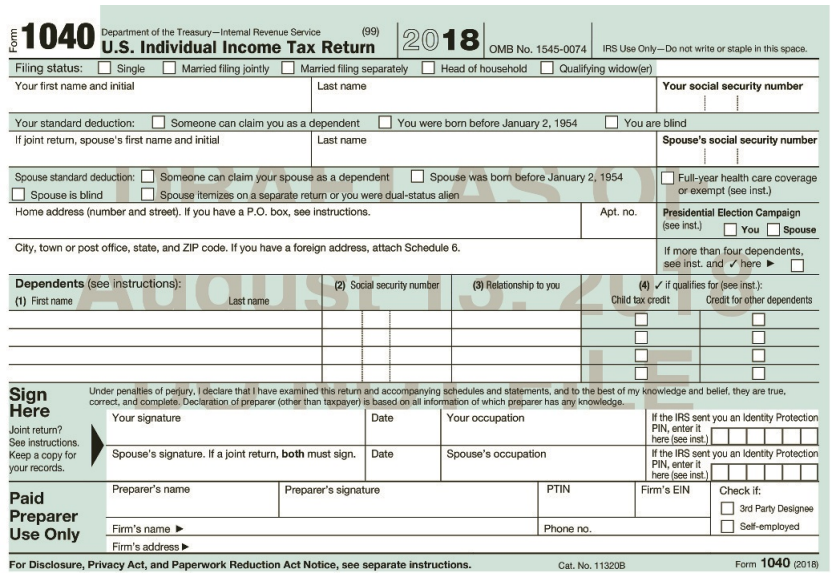

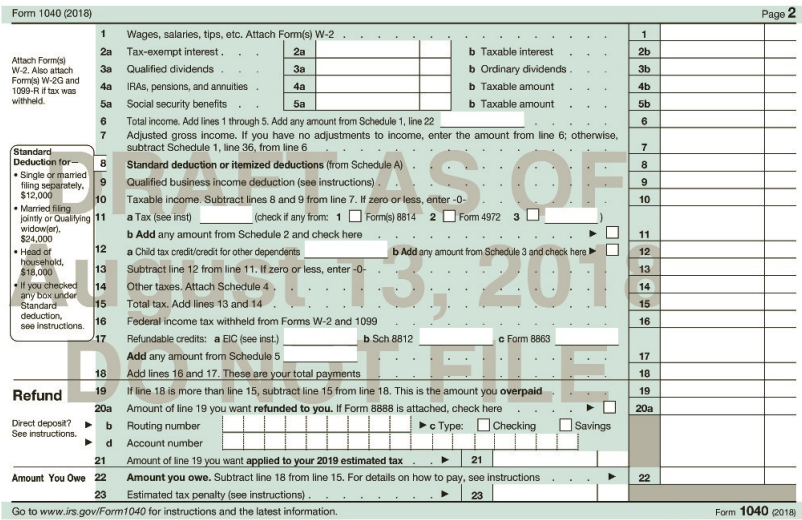

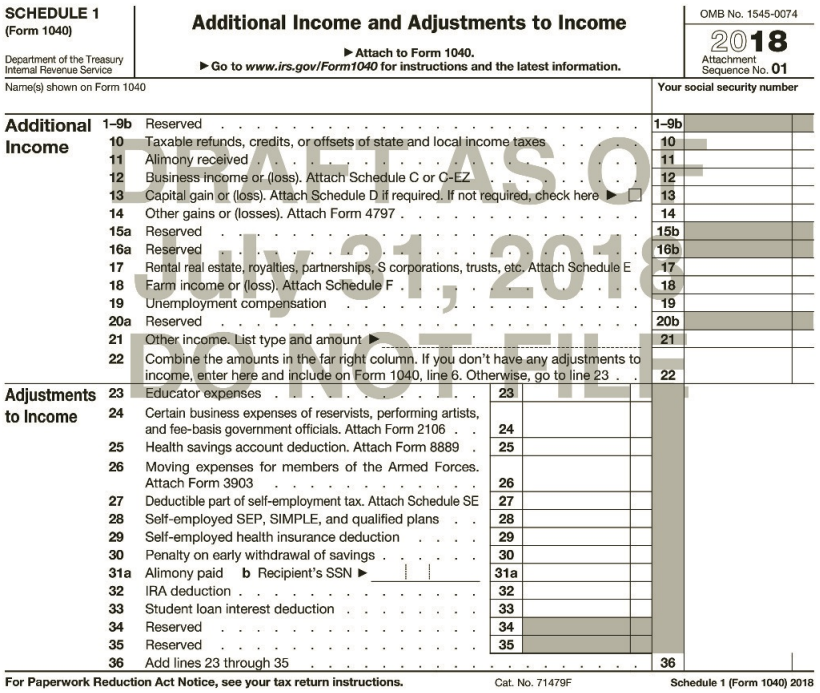

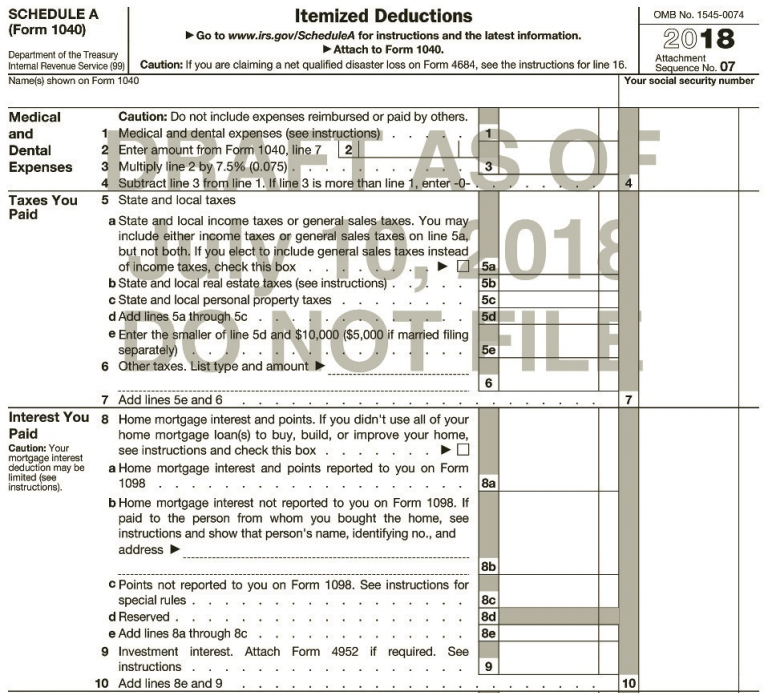

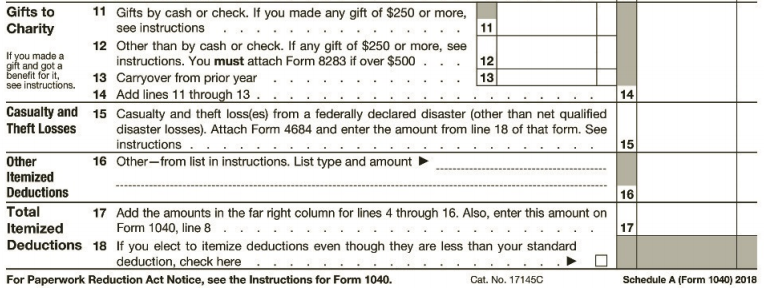

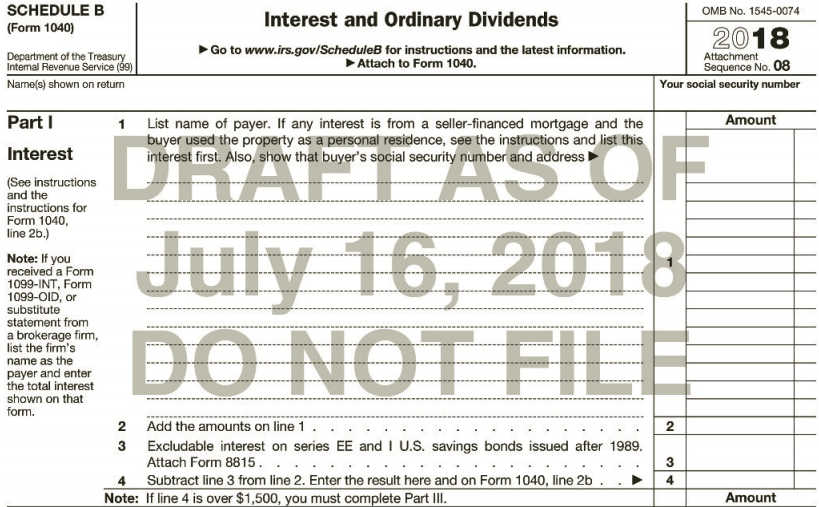

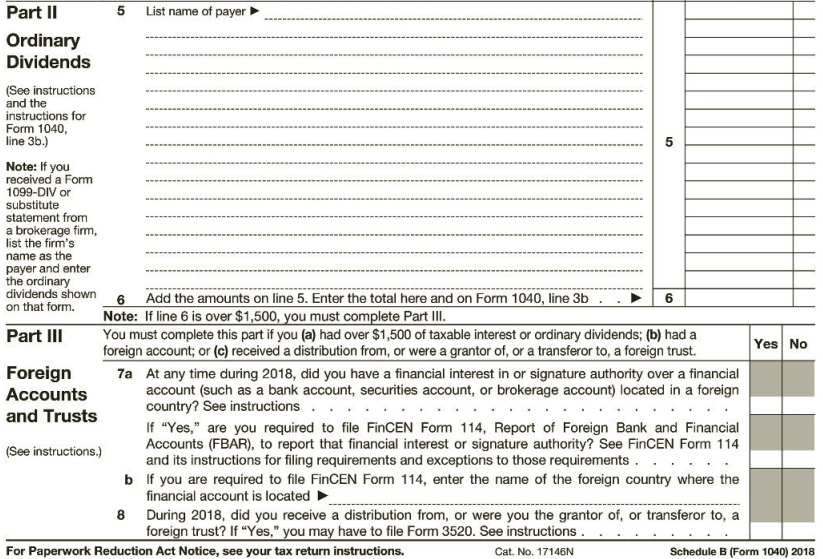

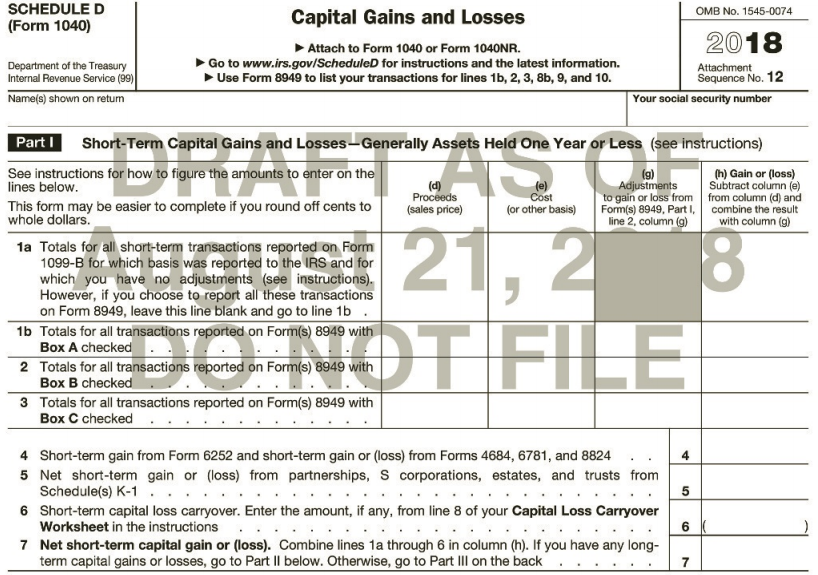

The following information is available for the Albert and Allison Gaytor family in addition to that provided in Chapters 1–7. On September 14, 2018, Allison purchased the building where her store is located. She paid $230,000 for the building and $100,000 for the land it is located on. Allison’s store is the only business in the building. The depreciation on the store needs to be reflected on Schedule C of the business.

Required:

Combine this new information about the Gaytor family with the information from Chapters 1–7 and complete a revised 2018 tax return for Albert and Allison. This completes the Group 5 multichapter case.

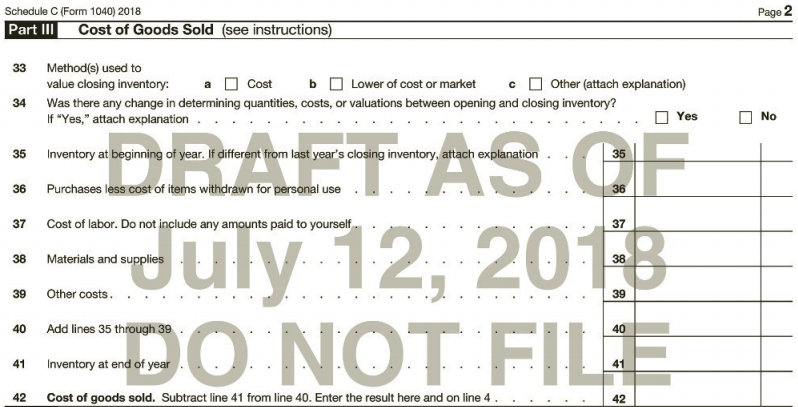

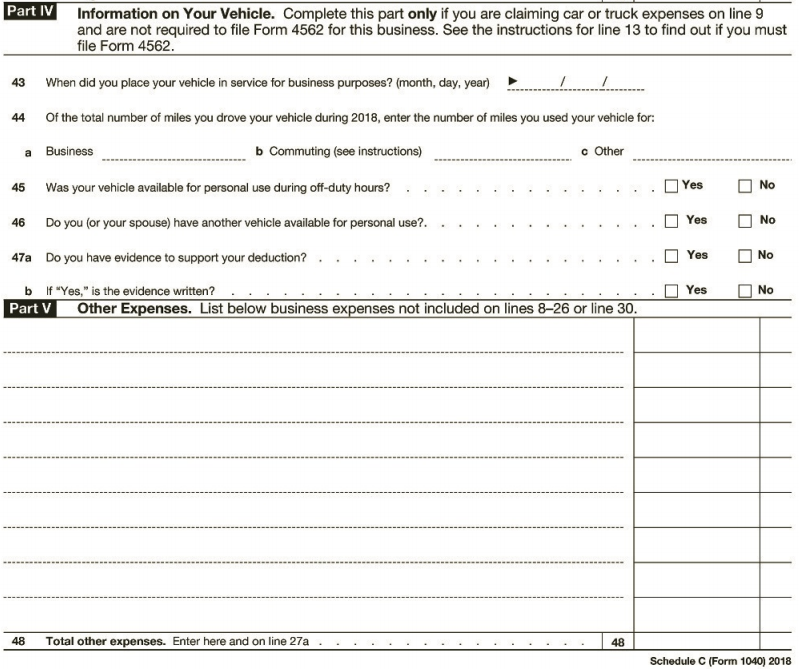

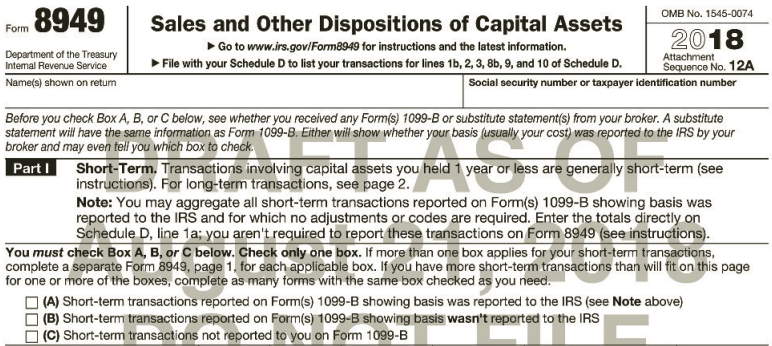

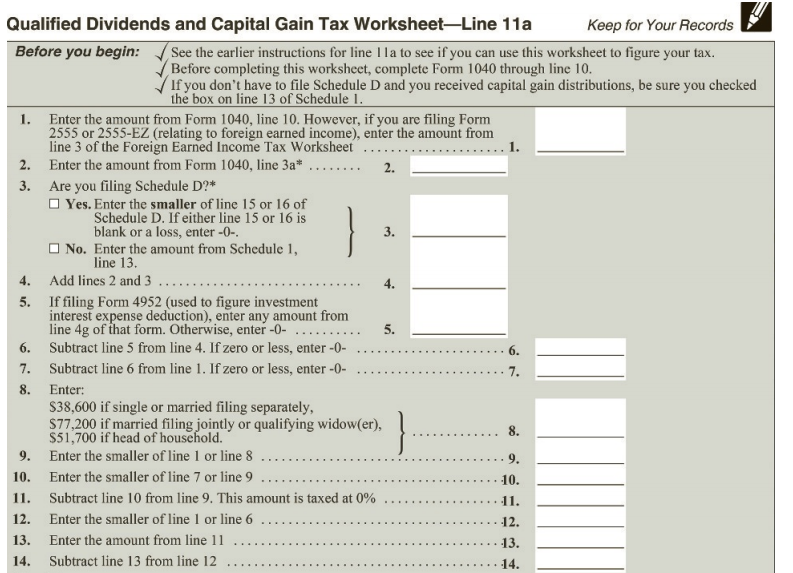

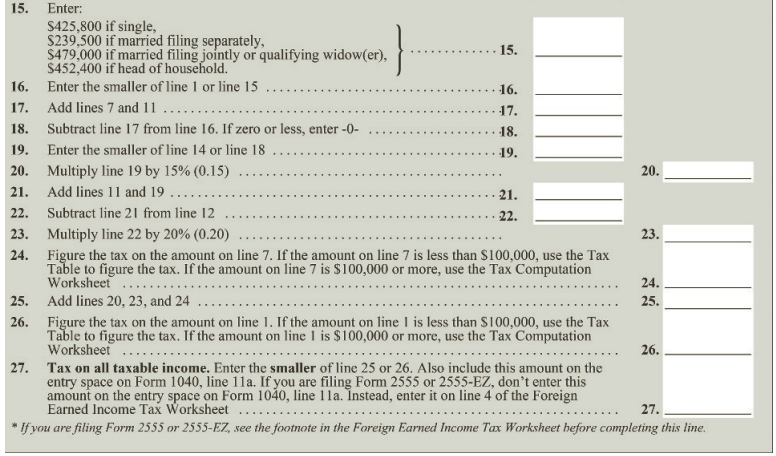

Profit or Loss From Business SCHEDULE C OMB No. 1545-0074 (Form 1040) (Sole Proprietorship) 2018 Attachment Sequence No. 09 Social security number (SSN) Go to www.irs.gov/ScheduleC for instructions and the latest information. Attach to Form 1040, 1040NR, or 1041; partnerships generally must file Form 1065. Department of the Treasury Internal Revenue Service (99) Name of proprietor B Enter code from instructions A Principal business or profession, including product or service (see instructions) DRAFT AS OF 22018 E FIL Business name. If no separate business name, leave blank. D Employer ID number (EIN) (see instr.) Business address (including suite or room no.) City, town or post office, state, and ZIP code Accounting method: (1) OCash Did you "materially participate" in the operation of this business during 2018? If "No," see instructions for limit on losses If you started or acquired this business during 2018, check here Did you make any payments in 2018 that would require you to file Form(s) 1099? (see instructions) If "Yes," did you or will you file required Forms 1099? Part I Income Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked 2 Returms and allowances Subtract line 2 from line 1 (3) D Other (specify). (2) DAccrual Yes O No н Yes No Yes No EONOT FILE 3 3 Cost of goods sold (from line 42) Gross profit. Subtract line 4 from line 3 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) 6. Gross income. Add lines 5 and 6 7. Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising . 9 Car and truck expenses (see Office expense (see instructions) Pension and profit-sharing plans 18 18 19 19 instructions). 20 Rent or lease (see instructions): a Vehicles, machinery, and equipment 20a b Other business property 10 Commissions and fees 10 11 Contract labor (see instructions) 11 20b 12 Depletion. Depreciation and section 179 expense deduction (not included in Part I) (see instructions). .. 12 21 Repairs and maintenance. 21 Supplies (not included in Part II) 13 22 22 23 Taxes and licenses . 23 13 24 Travel and meals: a Travel. 24a Employee benefit programs (other than on line 19). Insurance (other than health) Interest (see instructions): 14 b Deductible meals (see 14 15 15 instructions). 24b 16 25 Utilities 25 a Mortgage (paid to banks, etc.) ь other 17 Legal and professional services 16a 26 Wages (less employment credits). 26 16b 27a Other expenses (from line 48) . 27a b Reserved for future use 17 27b 28 Total expenses before expenses for business use of home. Add lines 8 through 27a 28 29 Tentative profit or (loss). Subtract line 28 from line 7. .. 29 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method (see instructions). Simplified method filers only: enter the total square footage of: (a) your home: and (b) the part of your home used for business: Method Worksheet in the instructions to figure the amount to enter on line 30 Use the Simplified 30 31 Net profit or (loss). Subtract line 30 from line 29. • If a profit, enter on both Schedule 1 (Form 1040), line 12 (or Form 1040NR, line 13) and on Schedule SE, line 2. (If you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. • If a loss, you must go to line 32. 31 32 If you have a loss, check the box that describes your investment in this activity (see instructions). • If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 12 (or Form 1040NR, line 13) and on Schedule SE, line 2. (If you checked the box on line 1, see the line 31 instructions). Estates and trusts, enter on Form 1041, line 3. • If you checked 32b, you must attach Form 6198. Your loss may be limited. 32a All investment is at risk. 32b Some investment is not at risk. For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11334P Schedule C (Form 1040) 2018

Step by Step Answer:

The revised 2018 tax return for Albert and Allison Gay tor would refle...View the full answer

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Students also viewed these Business questions

-

The following information is available for Karr Bowling Alley at December 31, 2012. Prepare a classified statement of financial position; assume that $13,900 of the notes payable will be paid in2013....

-

The following information is available for Silbermond Company: Assume a tax rate of 30%. Prepare a pro-forma income statement for the coming year forSilbermond. Beginning finished goods inventory. S...

-

The following information is available for Granite Inc. Instructions: Compute the missingamounts. Products in Sample Inventory Beginning inventory . $125 Materials available to use Ending inventory...

-

Assume your company shows the market values of equity and debt at the level of $175373 and $224626, respectively. The rate of return on assets is 33 percent and its volatility is 45 percent. The...

-

Refer to the information in E10-9 and assume Grocery Corporation accounts for the bond using the shortcut approach shown in Chapter Supplement 10C. E10-9 Grocery Corporation received $300,328 for...

-

Identify each conic without completing the squares and without applying a rotation of axes. 4x 2 + 4xy + y 2 85x + 165y = 0

-

Assuming a 10 percent annual discount rate, which system should EAMO purchase? Cost Estimates for EOP and PMS Year EOP ($) PMS ($) 0 (the current year) 1,500,000 750,000 1 100,000 300,000 2 100,000...

-

1. What problems might have contributed to the firms poor performance? 2. Although several problems were encountered in implementing the business plan, the primary reason for low profits turned out...

-

Project C0 C1 C2 A -2300 2200 1400 B -2300 1640 1768 Calculate the profitability index for A and B assuming a 25% opportunity cost of capital. (Do not round intermediate calculations. Round your...

-

Claire and Don formed Y Corporation to engage in the waste hauling and landfill business. Claire contributed a solid waste truck with a basis of $150,000 and a fair market value of $100,000 in...

-

Sherry Hopson owns a retail family clothing store. Her store is located at 4321 Heather Drive, Henderson, NV 89002. Her employer identification number is 95 1234321 and her Social Security number is...

-

During 2018, Jill, age 39, participated in a Section 401(k) plan which provides for maximum employee contributions of 12 percent. Jills salary was $90,000 for the year. Jill elects to make the...

-

The accountant of Lancer Copy Center encountered the following situations while adjusting and closing the books at February 28. Consider each situation independently. a. The accountant failed to make...

-

31. What is meant by path? 32. Give the formula for calculating D4 and D8 distance. 33. What is geometric transformation? 34. What is image translation and scaling? 35. Define the term Luminance

-

1. Explain Brightness adaptation and Discrimination 2.Explain sampling and quantization:

-

3. Explain about Mach band effect? 4. Explain color image fundamentals. 5. Explain CMY model.

-

1. Describe the fundamental steps in image processing? 2. Explain the basic Elements of digital image processing:

-

3. Explain the Structure of the Human eye 4. Explain the RGB model

-

Briefly outline how the elements of GAAP are applied.

-

Create an appropriate display of the navel data collected in Exercise 25 of Section 3.1. Discuss any special properties of this distribution. Exercise 25 The navel ratio is defined to be a persons...

-

For purposes of determining shared responsibility, household AGI is a. AGI for the taxpayer and spouse. b. AGI for the taxpayer, spouse and any other household members required to file a tax return....

-

Wilma had $3,100 in state income taxes withheld from her paychecks during 2018. In April of 2018, Wilma paid the $50 due for her 2017 state tax return. Wilmas total tax liability on her state tax...

-

Clarita is a single taxpayer with two dependent children, ages 10 and 12. Clarita pays $3,000 in qualified child care expenses during the year. If her adjusted gross income (all from wages) for the...

-

A company is evaluating a new 4-year project. The equipment necessary for the project will cost $3,300,000 and can be sold for $650,000 at the end of the project. The asset is in the 5-year MACRS...

-

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company...

-

I need to see where the calculations for this problem come from plz. 5. Award: 4.00 points Lucido Products markets two computer games: Claimjumper and Makeover. A contribution format income statement...

Study smarter with the SolutionInn App