Steve Drake sells a rental house on January 1, 2020, and receives $90,000 cash and a note

Question:

Steve Drake sells a rental house on January 1, 2020, and receives $90,000 cash and a note for $55,000 at 7 percent interest. The purchaser also assumes the mortgage on the property of $30,000. Steve’s original cost for the house was $172,000 on January 1, 2012 and accumulated depreciation was $32,000 on the date of sale. He collects only the $90,000 down payment in the year of sale.

a. If Steve elects to recognize the total gain on the property in the year of sale, calculate the taxable gain. $____________

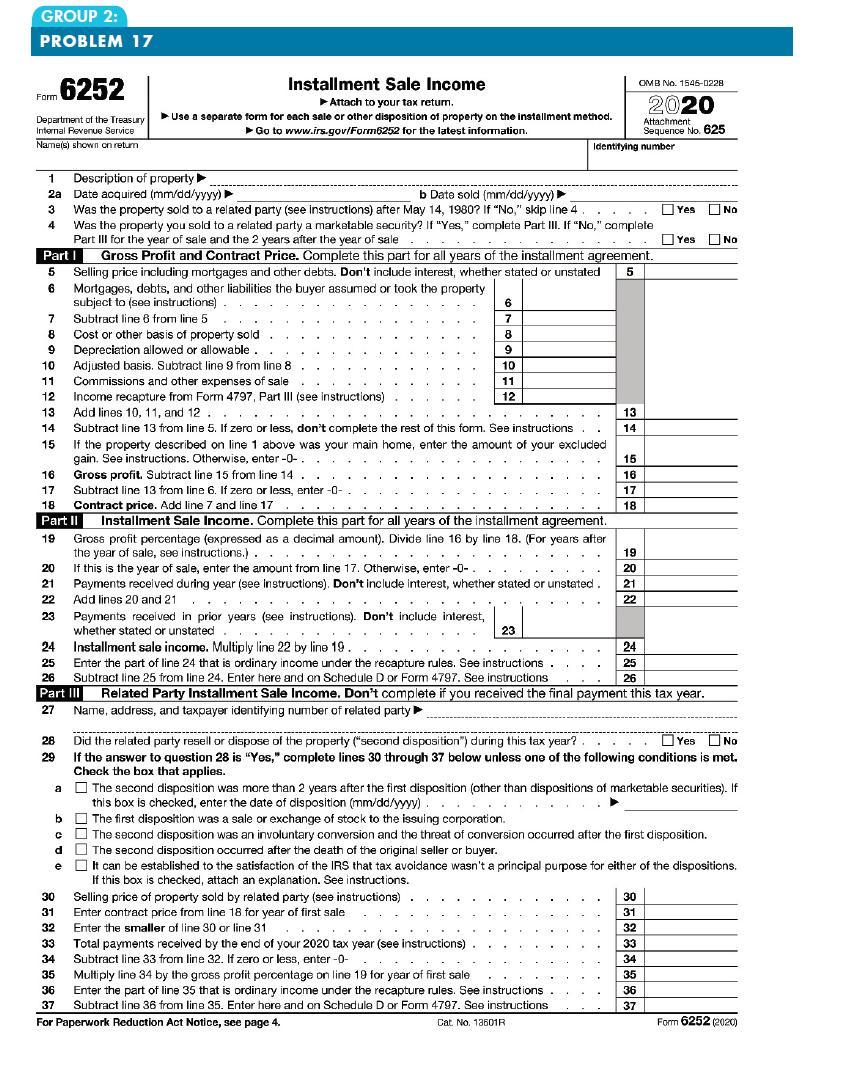

b. Assuming Steve uses the installment sale method, complete Form 6252 on Page 8-47 for the year of the sale.

c. Assuming Steve collects $5,000 (not including interest) of the note principal in the year following the year of sale, calculate the amount of income recognized in that year under the installment sale method. $___________

GROUP 2: PROBLEM 17 Form 6252 Department of the Treasury Internal Revenue Service Name(s) shown on return 6 Mortgages, debts, and other liabilities the buyer assumed or took the property subject to (see instructions) 7 Subtract line 6 from line 5 8 Cost or other basis of property sold 9 Depreciation allowed or allowable 10 Adjusted basis. Subtract line 9 from line 8 11 Commissions and other expenses of sale Income recapture from Form 4797, Part III (see instructions) Add lines 10, 11, and 12 ... .... Subtract line 13 from line 5. If zero or less, don't complete the rest of this form. See instructions 12 13 14 15 1 Description of property 2a Date acquired (mm/dd/yyyy) b Date sold (mm/dd/yyyy) 3 Was the property sold to a related party (see instructions) after May 14, 1980? If "No," skip line 4 Was the property you sold to a related party a marketable security? If "Yes," complete Part III. If "No," complete Part III for the year of sale and the 2 years after the year of sale 4 Part I Gross Profit and Contract Price. Complete this part for all years of the installment agreement. 5 Selling price including mortgages and other debts. Don't include interest, whether stated or unstated 5 16 17 18 Part II 20 21 22 23 Installment Sale Income Attach to your tax return. Use a separate form for each sale or other disposition of property on the installment method. Go to www.irs.gov/Form6252 for the latest information. 28 29 b C d e If the property described on line 1 above was your main home, enter the amount of your excluded main See inst gain. See instructions. Otherwise, enter -0. Gross profit. Subtract line 15 from line 14 Subtract line 13 from line 6. If zero or less, enter -0- Contract price. Add line 7 and line 17 19 Gross profit percentage (expressed as a decimal amount). Divide line 16 by line 18. (For years after the year of sale, see instructions.) If this the year of sale, enter the amount from line 17. Otherwise, enter -0- 30 31 32 6 7 8 9 10 11 12 Installment Sale Income. Complete this part for all years of the installment agreement. mei care conc .... Identifying number Payments received during year (see instructions). Don't include interest, whether stated or unstated. Add lines 20 and 21 T 23 . 13 14 15 16 17 18 ........... Payments received in prior years (see instructions). Don't include interest, whether stated or unstated Jestell 24 Installment sale income. Multiply line 22 by line 19. Exter 25 Enter the part of line 24 that is ordinary income under the recapture rules. See instructions. 26 Subtract line 25 from line 24. Enter here and on Schedule D or Form 4797. See instructions Part III Related Party Installment Sale Income. Don't complete if you received the final payment this tax year. 27 Name, address, and taxpayer identifying number of related party 19 20 21 22 OMB No. 1546-0228 2020 Attachment Sequence No. 625 24 25 26 a The second disposition was more than 2 years after the first disposition (other than dispositions of marketable securities). If this box is checked, enter the date of disposition (mm/dd/yyyy).. The first disposition was a sale or exchange of stock to the issuing corporation. The second disposition was an involuntary conversion and the threat of conversion occurred after the first disposition. The second disposition occurred after the death of the original seller or buyer. It can be established to the satisfaction of the IRS that tax avoidance wasn't a principal purpose for either of the dispositions. If this box is checked, attach an explanation. See instructions. Selling price of property sold by related party (see instructions) Enter contract price from line 18 for year of first sale Enter the smaller of line 30 or line 31 33 Total payments received by the end of your 2020 tax year (see instructions) 34 Subtract line 33 from line 32. If zero or less, enter-0- 35 Multiply line 34 by the gross profit percentage on line 19 for year of first sale 36 Enter the part of line 35 that is ordinary income under the recapture rules. See instructions 37 Subtract line 36 from line 35. Enter here and on Schedule D or Form 4797. See instructions For Paperwork Reduction Act Notice, see page 4. Cat. No. 13601R Yes No Did the related party resell or dispose of the property ("second disposition") during this tax year?. Yes No If the answer to question 28 is "Yes," complete lines 30 through 37 below unless one of the following conditions is met. Check the box that applies. 30 31 32 Yes No 33 34 35 36 37 Form 6252 (2020)

Step by Step Answer:

a 35000 gain 90000 55000 30000 140000 b See Form 6252 on page 811 c 1205 241 from Form 6252 Part II x 5000 Form 6252 Installment Sale Income Attach to your tax retum Department of the Treasury Use a s...View the full answer

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Students also viewed these Business questions

-

Steve Drake sells a rental house on January 1, 2012, and receives $130,000 cash and a note for $55,000 at 10 percent interest. The purchaser also assumes the mortgage on the property of $45,000....

-

Steve Drake sells a rental house on January 1, 2018, and receives $120,000 cash and a note for $45,000 at 10 percent interest. The purchaser also assumes the mortgage on the property of $35,000....

-

Steve Drake sells a rental house on January 1, 2014, and receives $130,000 cash and a note for $55,000 at 10 percent interest. The purchaser also assumes the mortgage on the property of $45,000....

-

Limits from graph In this problem we evaluate limits from the graph. Consider the graph of f given in [Figure 1]. Evaluate each of the following limits (or explain why if the limit does not exist)....

-

Jesse worked as a buyer for the Vegetable Co. Rachel offered to sell Jesse 10 tons of tomatoes for the account of Vegetable. Jesse accepted the offer. Later, Jesse discovered that Rachel was an agent...

-

During the Great Depression, the United States remained on the international gold standard longer than other countries. This effectively meant that the United States was committed to maintaining a...

-

A stock has volatility \(\sigma=.30\) and a current value of \(\$ 36\). An American put option on this stock has a strike price of \(\$ 40\), and expiration is in 5 months. The interest rate is \(8...

-

Tyler Countys general fund starts the fiscal year 2020 with a $250,000 balance for net property taxes receivable. The balance is net of a $200,000 allowance for uncollectible taxes. The county also...

-

Here are summary numbers from a firm's financial statements (in millions of dollars): < 2018 2019 2020 < 2021 Operating Income < 935.00 1,000.45 1,070.50 1,145.40 Net operating Assets < 6,072.25...

-

Which of the following is not considered a limit on the immediate expensing election of Section 179? a. Fifty percent of qualified improvement property b. Total Section 179-eligible property acquired...

-

Jeanie acquires an apartment building in 2009 for $280,000 and sells it for $480,000 in 2020. At the time of sale there is $60,000 of accumulated straight-line depreciation on the apartment building....

-

This interesting exercise is worthwhile in: 1. Providing the opportunity for political self-assessment (some students will be rather uncomfortable with their results) 2. Helping students understand...

-

How is high-frequency trading similar to broker-dealer internalization? How is it different?

-

A written contract or agreement. a. administrator b. antenuptial or prenuptial a greement c. auctioneer d. executor e. guaranty f. memorandum g. parol evidence rule h. personal prope rty i. real...

-

How many iterations of your loop from 4.35.4 can be in light within this processors pipeline? We say that an iteration is in light when at least one of its instructions has been fetched and has not...

-

Which method should be used if management anticipates a period of inflation? Why?

-

What are the four methods used to account for inventory?

-

What is the management cycle and how does it relate to strategic and short-term planning?

-

Subtract the polynomials. (-x+x-5) - (x-x + 5)

-

America Los Rios (age 36) is a single taxpayer, living at 4700 Oak Drive, Sacramento, CA 95841. Her Social Security number is 976-23-5132. Americas earnings and income tax withholding as the manager...

-

Lisa Kohl (age 44) is a single taxpayer and she lives at 212 Quivira Road, Overland Park, KS 66210. Her Social Security number is 467-98-9784. Lisas earnings and income tax withholding as the...

-

The following information is available for the Albert and Allison Gaytor family in addition to that provided in Chapters 17. Albert sold the following securities during the year and received a Form...

-

Carlton Bank has an increase in reserves of $1,000,000. If the reserve ratio is 10%, by what amount may Carlton increase its demand deposits?

-

What strategies might you use to implement the personal change needed to support organizational change? What is the relevance of unity consciousness in organizational leadership, communications, and...

-

Recognizing the literature (and its limitations) for conveying policing organization, management, and change - what management/organizational changes are needed in policing today? Why? How do we set...

Study smarter with the SolutionInn App