Yolanda is a cash-basis taxpayer with the following transactions during the year: Cash received from sales of

Question:

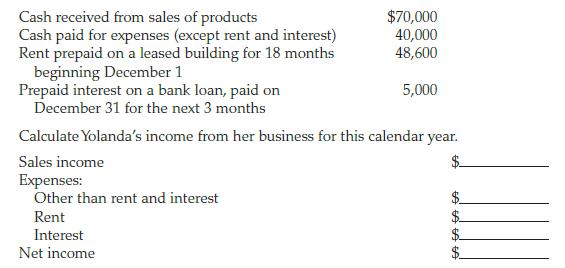

Yolanda is a cash-basis taxpayer with the following transactions during the year:

Transcribed Image Text:

Cash received from sales of products Cash paid for expenses (except rent and interest) Rent prepaid on a leased building for 18 months beginning December 1 Prepaid interest on a bank loan, paid on December 31 for the next 3 months $70,000 40,000 48,600 5,000 Calculate Yolanda's income from her business for this calendar year. Sales income Expenses: Other than rent and interest Rent Interest Net income EA LA LA LA

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (6 reviews)

Sales income Expenses O...View the full answer

Answered By

William Otieno

I am a professional tutor and a writer with excellent skills that are important in serving the bloggers and other specialties that requires a great writer. The important aspects of being the best are that I have served so many clients with excellence

With excellent skills, I have acquired very many recommendations which have made it possible for me to survive as an excellent and cherished writer. Being an excellent content writer am also a reputable IT writer with essential skills that can make one turn papers into excellent result.

4.70+

83+ Reviews

354+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Yolanda is a cash basis taxpayer with the following transactions during the year: Cash received from sales of products........... $65,000 Cash paid for expenses (except rent and interest)..........

-

Yolanda is a cash basis taxpayer with the following transactions during the year: Cash received from sales of products........................................................................$65,000...

-

Yolanda is a cash basis taxpayer with the following transactions during the year: Calculate Yolandas income from her business for this calendar year.

-

Midland Corporation has a net income of $19 million and 4 million shares outstanding. Its common stock is currently selling for $48 per share. Midland plans to sell common stock to set up a major new...

-

Berkshire Controllers usually finances its engineering projects with a combination of debt and equity capital. The resulting MARR ranges from a low of 4% per year, if business is slow, to a high of...

-

Dominique is a manager for a regional bank. He is being relocated several states away to act as a temporary manager while a new branch is interviewing for a permanent manager. He will leave on May 1,...

-

A pension fund has just paid some of its liabilities, and as a result of this transaction the fund is no longer fully immunized. The fund manager decides that instead of changing the portfolio, the...

-

The city of Morristown operates a printing shop through an Internal Service Fund to provide printing services for all departments. The Central Printing Fund was established by a contribution of...

-

1. Suggest at least three ideas educators could use to involve service personnel in developing an environmental responsibility plan focused on reducing energy. 2. Name two qualitative evaluation...

-

Geraldine is an accrual-basis taxpayer who has the following transactions during the current calendar tax year: Accrued business income (except rent) Accrued business expenses (except rent) Rental...

-

Warner and Augustine Robins, both 35 years old, have been married for 9 years and have no dependents. Warner is the president of Jaystar Corporation located in Macon, Georgia. The Jaystar stock is...

-

The ratio of the masses of the two naturally occurring isotopes of indium is 1.0177:1. The heavier of the two isotopes has 7.1838 times the mass of 16 O. What are the masses in u of the two isotopes?

-

Indicate whether each of the following statements is true or false by writing T or F i n t he a nswer c olumn. Slander is a spoken, and libel is a written, form of defamation.

-

To what types of risk are investors of foreign bonds exposed?

-

Indicate whether each of the following statements is true or false by writing T or F i n t he a nswer c olumn. Offshore gambling refers to foreign citizens placing bets in casinos located within the...

-

What is the statement of stockholders equity, and what information does it provide?

-

Why is a call provision advantageous to a bond issuer?

-

Given the following events, prepare the necessary journal entries on behalf of ABC Company: A. Jeff Gray placed an order for merchandise and made a $ 2,000 deposit. B. ABC Company notified Jeff that...

-

The graph of an equation is given. (a) Find the intercepts. (b) Indicate whether the graph is symmetric with respect to the x-axis, the y-axis, or the origin. -3 6 -6 3 x

-

The IRS maintains a section called News and Events. Locate this website and print out the first page of the first item appearing on News and Events.

-

Noah and Joan Arc live with their family at 4342 Josie Jo, Santee, CA 92071. Noahs Social Security number is 434-11-3311; Joans is 456-87-5432. Both are in their mid-30s and enjoy good health and...

-

Gregory R. and Lulu B. Clifden live with their family at the Rock Glen House Bed & Breakfast, which Gregory operates. The Bed & Breakfast (B&B) is located at 33333 Fume Blanc Way, Temecula, CA 92591....

-

ound your answers to 2 decimal places. d) Ignoring your previous answers, assume that Clorox Inc. estimates that the per ton selling price will decline 10% next year. Variable costs will increase...

-

On January 1, 2020, Allen Corp. purchased equipment for $745,000. At the time, it was estimated that the equipment would have a 20 year useful life, and a salvage value of $30,000 at the end of that...

-

Adams, Inc. sells widgets that come with an unconditional five-year warranty. According to Adams' best estimates, 7.8% of all units sold will require repair or replacement under that warranty, and...

Study smarter with the SolutionInn App