Warner and Augustine Robins, both 35 years old, have been married for 9 years and have no

Question:

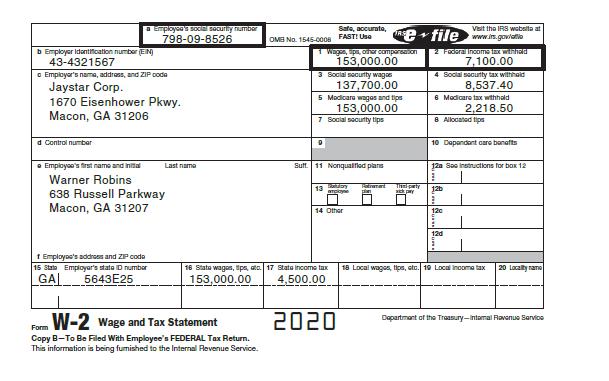

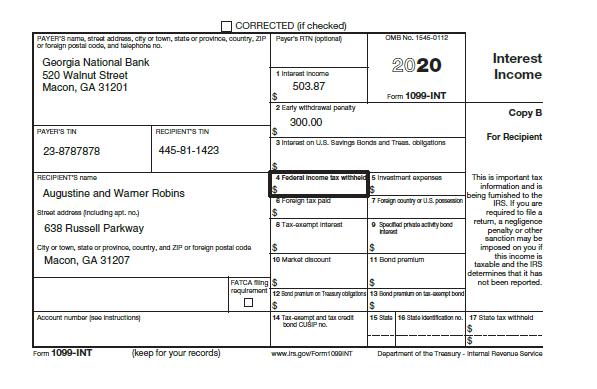

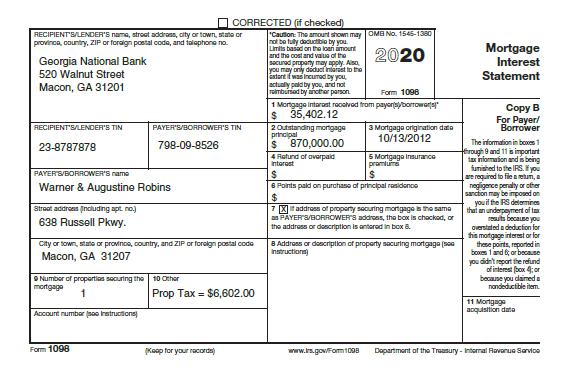

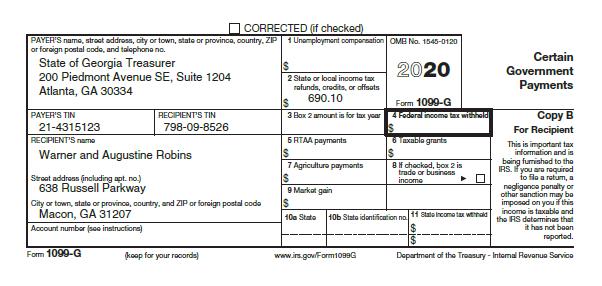

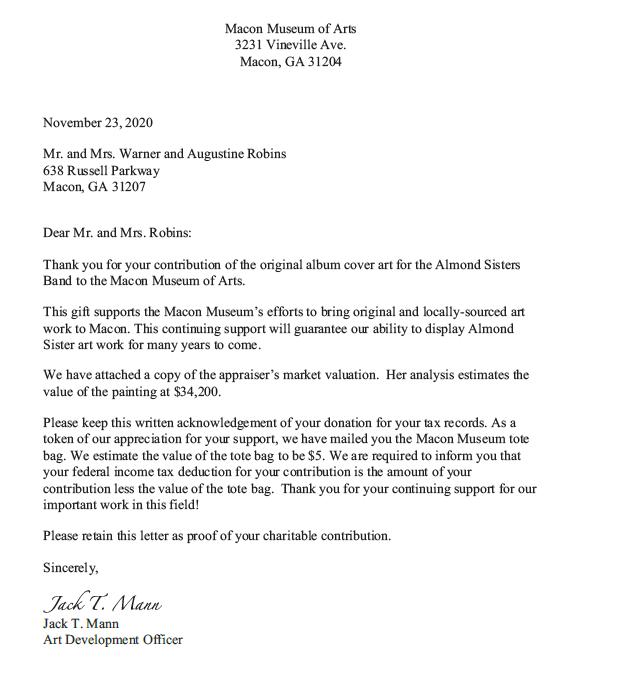

Warner and Augustine Robins, both 35 years old, have been married for 9 years and have no dependents. Warner is the president of Jaystar Corporation located in Macon, Georgia. The Jaystar stock is owned 40 percent by Warner, 40 percent by Augustine, and 20 percent by Warner’s father. Warner and Augustine received the following tax documents:

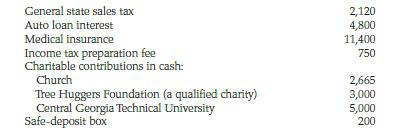

The Robins paid the following amounts (all can be substantiated):

The Robins had total itemized deductions of $33,567 in 2019 which included a $9,600 state tax deduction.

The tax basis for the donated painting is $25,000 and the painting has been owned by Warner and Augustine for 5 years.

Jaystar does not cover health insurance for its employees. In addition to Warner and Augustine’s health insurance premiums shown above, Augustine required surgery which cost $6,663 for which only $3,021 was covered by insurance. Warner had to drive Augustine 125 miles each way to a surgical center.

On January 1, 2020, Warner sold land to Jaystar Corporation for $75,000. He acquired the land 5 years ago for $160,000. No Form 1099-B was filed for this transaction.

Jaystar Corporation does not have a qualified pension plan or Section 401(k) plan for its employees. Therefore, Warner deposited $12,000 ($6,000 each) into traditional IRA accounts for Augustine and himself (neither are covered by a qualified plan at work).

The Robins received a $2,400 EIP in 2020.

Required:

Complete the Robins’ federal tax return for 2020. Use Form 1040, Schedule 1, Schedule A, Schedule D, and Form 8949 to complete this tax return. Make realistic assumptions about any missing data and ignore any alternative minimum tax. Do not complete Form 8283, which is used when large noncash donations are made to charity.

Step by Step Answer:

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill