Question: Create the following 6 financial analysis reports for Kyle Corporation and provide an analysis as requested: a. Income Statement (Horizontal) report with a run date

Create the following 6 financial analysis reports for Kyle Corporation and provide an analysis as requested:

a. Income Statement (Horizontal) report with a run date of 12/31/€“. Provide a narrative analysis of this report in a manner similar to that done in the chapter. Use your own words based on the information provided in this report.

b. Income Statement (Vertical) report with a run date of 12/31/€“. Provide a narrative analysis of this report in a manner similar to that done in the chapter. Use your own words based on the information provided in this report.

c. Balance Sheet (Horizontal) report with a run date of 12/31/€“. Provide a narrative analysis of this report in a manner similar to that done in the chapter. Use your own words based on the information provided in this report.

d. Balance Sheet (Vertical) report with a run date of 12/31/€“. Provide a narrative analysis of this report in a manner similar to that done in the chapter. Use your own words based on the information provided in this report.

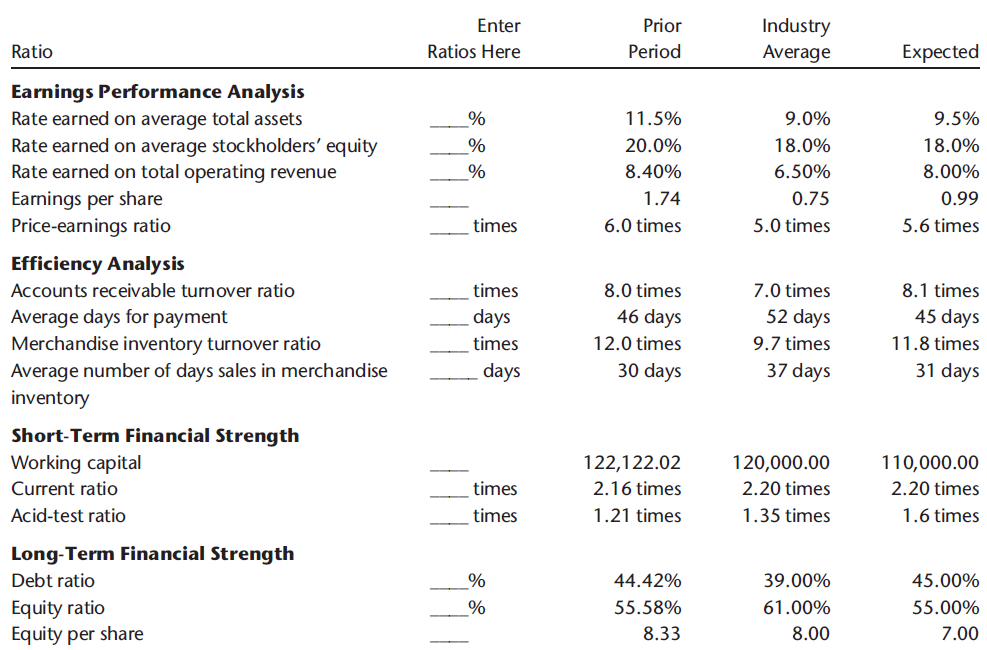

e. Ratio Analysis report with a run date of 12/31/€“. (Use 50,000 shares outstanding and $6.00 price per share) Complete the table below and then provide a narrative analysis of this report in a manner similar to that done in the chapter. Use your own words based on the information provided in this report.

f. Statement of Cash Flows report with a run date of 12/31/€“. Provide a narrative analysis of this report in a manner similar to that done in the chapter. Use your own words based on the information provided in this report.

Enter Prior Industry Average Period Ratio Ratios Here Expected Earnings Performance Analysis Rate earned on average total assets Rate earned on average stockholders' equity Rate earned on total operating revenue Earnings per share Price-earnings ratio 11.5% 9.0% 9.5% 18.0% 20.0% 18.0% 8.40% 6.50% 8.00% 1.74 0.75 0.99 times 6.0 times 5.0 times 5.6 times Efficiency Analysis 8.1 times Accounts receivable turnover ratio times 8.0 times 7.0 times Average days for payment Merchandise inventory turnover ratio Average number of days sales in merchandise inventory 46 days 52 days 45 days days 11.8 times times 12.0 times 9.7 times 37 days 30 days 31 days days Short-Term Financial Strength Working capital 122,122.02 120,000.00 110,000.00 Current ratio times 2.16 times 2.20 times 2.20 times Acid-test ratio times 1.21 times 1.35 times 1.6 times Long-Term Financial Strength Debt ratio 44.42% 39.00% 45.00% Equity ratio Equity per share 55.58% 61.00% 55.00% 8.33 8.00 7.00

Step by Step Solution

3.43 Rating (169 Votes )

There are 3 Steps involved in it

a Interpreting this horizontal analysis reveals some significant changes Gross profit increased 3323564 1423 but net income after income tax only increased 652410 939 The question is why Part of the a... View full answer

Get step-by-step solutions from verified subject matter experts