Question: In this problem, you will perform the accounting system setup for Wright Cleaning Service, a cleaning service owned and operated by Laurie Wright. Wright Cleaning

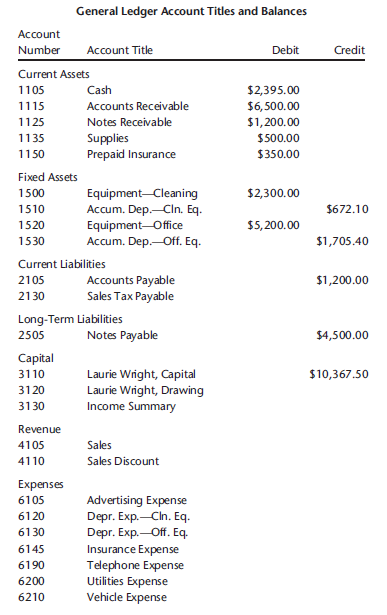

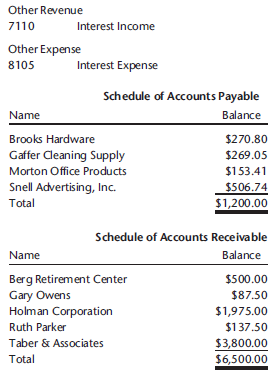

In this problem, you will perform the accounting system setup for Wright Cleaning Service, a cleaning service owned and operated by Laurie Wright. Wright Cleaning Service is a service business that is organized as a sole proprietorship, is non-departmentalized, prepares checks manually, generates the income statement by fiscal period, and uses a standard accounting system. The trial balance, schedule of accounts payable, and schedule of accounts receivable for Wright Cleaning Service as of February 1 of the current year are provided as follows:

Complete the following steps and answer Audit Questions 11-B on page 506 as you work through the problem.

Step 1: Start Integrated Accounting 8e.

Step 2: Use the New command from the File menu to prepare the computer for setup.

Step 3: Enter your name in the Your Name text box.

Step 4: Enter information into the data fields and set the check boxes and option buttons in Setup Accounting System.

Step 5: Enter the chart of accounts data.

Step 6: Enter the vendors.

Step 7: Enter the customers.

Step 8: Verify account classification and extended account classification account number ranges.

Step 9: Verify the required accounts data.

Step 10: Enter the following account subtotals:

Total Current Assets

Total Fixed Assets

Total Current Liabilities

Total Long-Term Liabilities

Step 11: Enter the opening balances from the trial balance, schedule of accounts payable, and schedule of accounts receivable (shown at the beginning of this problem) into the general journal.

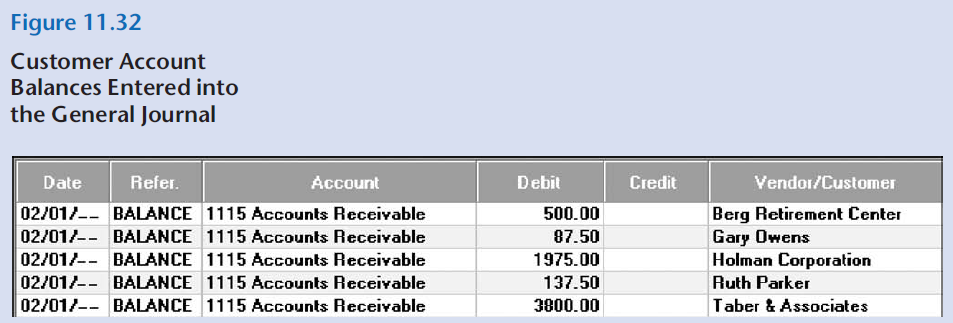

Because this accounting system does not involve an inventory, the vendor and customer account balances shown in the schedules of accounts payable and accounts receivable must be entered with the rest of the opening balances in the general journal to establish the accounts receivable and accounts payable account balances. Figure 11.32 shows how the customer balances are entered (the same procedure is required to enter the vendor balances).

Step 12: Display a chart of accounts, vendor list, and customer list. (Be sure to set the run date to February 1 of the current year.)

Step 13: Display a trial balance, schedule of accounts payable, and schedule of accounts receivable.

Step 14: Display a balance sheet.

Step 15: Save your data with a file name of 11-B Your Name.

Step 16: End your Integrated Accounting 8e session.

General Ledger Account Titles and Balances Account Number Debit Credit Account Title Current Assets Cash $2,395.00 $6, 500.00 $1,200.00 1105 Accounts Receivable 1115 Notes Receivable 1125 Supplies Prepaid Insurance $500.00 1135 $350.00 1150 Fixed Assets Equipment-Cleaning Accum. Dep.-Cin. Eq. $2,300.00 1500 1510 $672.10 $5,200.00 1520 Equipment-Office Accum. Dep.-Off. Eq. 1530 $1,705.40 Current Liabilities Accounts Payable Sales Tax Payable $1,200.00 2105 2130 Long-Term Liabilities Notes Payable $4,500.00 2505 Capital Laurie Wright, Capital Laurie Wright, Drawing Income Summary $10,367.50 3110 3120 3130 Revenue Sales 4105 Sales Discount 4110 Expenses 6105 Advertising Expense Depr. Exp.-Cin. Eq. Depr. Exp.-Off. Eq. Insurance Expense 6120 6130 6145 Telephone Expense Utilities Expense Vehidle Expense 6190 6200 6210 Other Revenue 7110 Interest Income Other Expense 8105 Interest Expense Schedule of Accounts Payable Name Balance Brooks Hardware $270.80 Gaffer Cleaning Supply $269.05 Morton Office Products $153.41 Snell Advertising, Inc. $506.74 Total $1,200.00 Schedule of Accounts Receivable Name Balance Berg Retirement Center Gary Owens Holman Corporation $500.00 $87.50 $1,975.00 Ruth Parker $137.50 Taber & Associates $3,800.00 $6,500.00 Total

Step by Step Solution

3.46 Rating (179 Votes )

There are 3 Steps involved in it

Wright Cleaning Service Chart of Accounts 0201 Assets 1105 Cash 1115 Accounts Receivable 1125 Notes ... View full answer

Get step-by-step solutions from verified subject matter experts