During 2015, Graham Co.s first year of operations, the company reports pretax financial income of 250,000. Grahams

Question:

During 2015, Graham Co.’s first year of operations, the company reports pretax financial income of £250,000. Graham’s enacted tax rate is 40% for 2015 and 35% for all later years. Graham expects to have taxable income in each of the next 5 years.

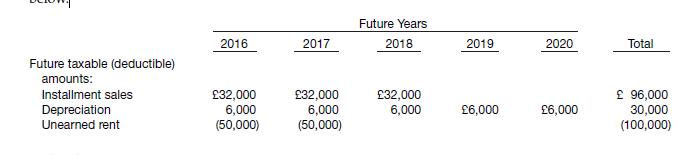

The effects on future tax returns of temporary differences existing at December 31, 2015, are summarized below.

Instructions

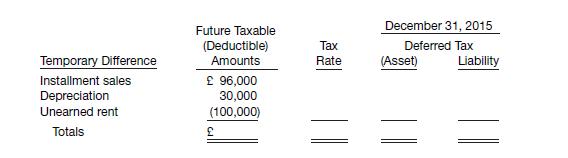

(a) Complete the schedule below to compute deferred taxes at December 31, 2015.

(b) Compute taxable income for 2015.

(c) Prepare the journal entry to record income taxes payable, deferred taxes, and income tax expense for 2015.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted: