Presented below are two independent situations related to future taxable and deductible amounts resulting from temporary differences

Question:

Presented below are two independent situations related to future taxable and deductible amounts resulting from temporary differences existing at December 31, 2022.

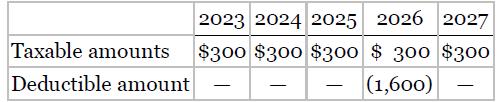

1. Mooney Co. has developed the following schedule of future taxable and deductible amounts.

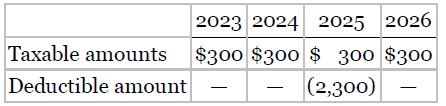

2. Roesch Co. has the following schedule of future taxable and deductible amounts.

Both Mooney Co. and Roesch Co. have taxable income of $4,000 in 2022 and expect to have taxable income in all future years. The tax rates enacted as of the beginning of 2022 are 30% for 2022–2025 and 35% for years thereafter.

Instructions

For each of these two situations, compute the net amount of deferred income taxes to be reported at the end of 2022, and indicate how it should be classified on the statement of financial position.

Step by Step Answer:

Intermediate Accounting IFRS

ISBN: 9781119607519

4th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield