On January 1, 2019, Jones Company acquires a 30% interest in Fink Company by purchasing 3,000 of

Question:

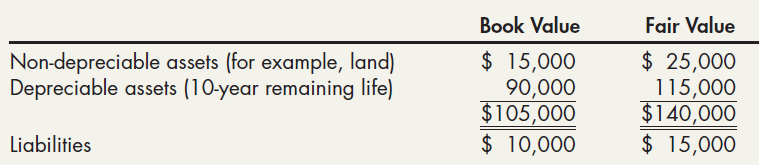

On January 1, 2019, Jones Company acquires a 30% interest in Fink Company by purchasing 3,000 of its 10,000 common shares for $16 per share and obtains significant influence. On the date of acquisition, the net assets of Fink were as shown here:

During 2019, Fink earned income of $22,000 and paid dividends of $6,000.

Required:

Prepare all journal entries on Jones’s books to record the acquisition, dividends, and income from the investment in Fink. Show supporting calculations.

Book Value $ 15,000 90,000 $105,000 $ 10,000 Fair Value Non-depreciable assets (for example, land) Depreciable assets (10-year remaining life) $ 25,000 115,000 $140,000 $ 15,000 Liabilities

Step by Step Answer:

2019 Jan 1 Investment in Stock Fink Company 48000 Cash 3000 16 4800...View the full answer

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

On January 1, 2019, Crouser Company sold land to Chad Company, accepting a 2-year, $150,000, non-interest-bearing note due January 1, 2021. The fair value of the land was $123,966.90 on the date of...

-

The following information is available concerning Nunan Corporations sinking fund: 2019 Jan. 1 Established a sinking fund to retire an outstanding bond issue by contributing $425,000. Feb. 3...

-

The following independent situations require professional judgment for determining when to recognize revenue from the transactions. a. Southwest Airlines sells you an advance-purchase airline ticket...

-

The following linear systems Ax = b have x as the actual solution and x as an approximate solution. Compute ||x x|| and ||Ax b|| a. 1/2 x1 + 1/3 x2 = 1/63, 1/3 x1 + 1/4 x2 = 1/168, x = ( 1/7 ,1/6)t...

-

A cylindrical brass container with a base of 75.0 cm2 and height of 20.0 cm is filled to the brim with water when the system is at 25.0 C. How much water overflows when the temperature of the water...

-

Graph the following equations. Use a graphing utility only to check your work. a. 2x 3y + 10 = 0 b. y = x + 2x - 3 2 c. x + 2x + y + 4y + 1 = 0 d. x 2x + y 8y + 5 = 0

-

In the benzene adsorber of Example 9.7, the flow rate is increased to \(0.25 \mathrm{~m}^{3} / \mathrm{s}\). Calculate the breakthrough time and the fraction of the bed adsorption capacity that has...

-

Jims Outfitters, Inc., makes custom fancy shirts for cowboys. The shirts could be flawed in various ways, including flaws in the weave or color of the fabric, loose buttons or decorations, wrong...

-

Find the range of the function defined by the equation and the given domain. f(x) = 4x3; domain= {0, 1, 2, 3}

-

Carlsbad Corporations sales are expected to increase from $5 million in 2018 to $6 million in 2019, or by 20%. Its assets totaled $3 million at the end of 2018.Carlsbad is at full capacity, so its...

-

On January 1, 2019, Field Company acquired 40% of North Company by purchasing 8,000 shares for $144,000 and obtained significant influence. On the date of acquisition, Field calculated that its share...

-

On January 1, 2019, Worthylake Company sold used machinery to Brown Company, accepting a $25,000, non-interest-bearing note maturing on January 1, 2021. Worthylake carried the machinery on its books...

-

In Exercises 8184, use the screen to write the equation being solved. Then use the table to solve the equation. Y=

-

Briefly describe the activity of Aconitase in cells at A) high and B) low iron concentrations. Bonus: Why is this often called "moonlighting"?

-

Two firms compete and choose quantities. Firm 1 chooses first (unchangeable) Demand is given by D(p) = 300 ? 3p and each firms marginal cost is MC(q) = 3q. What quantity does firm 1 choose? What...

-

If the following are the only accounts of Jones Supply Company, what is the missing Supplies balance? Cash: $10,130 Supplies: ????? Accounts Payable: $4,000 John Smith, Capital: $11,080

-

Identify the enzymes involved in the development of Tay Sachs and Phenylketonuria. Briefly describe how a lack of the respective enzyme leads to each disease.

-

Predict the outcome of the following reactions a) CI MeOH, Et3N CI .8 $ NH H* ? ? b) d) 8 CI, AICI3 H .HO* ?

-

Assume all of the same facts and scenarios as E 12-30, except that Bloom Corporation classifies their Taylor investment as AFS. In E12-30 Bloom Corporation purchased $1,000,000 of Taylor Company 5%...

-

Heineken N.V., a global brewer based in the Netherlands, reports the following balance sheet accounts for the year ended December 31, 2016 (euros in millions). Prepare the balance sheet for this...

-

On January 1, 2013, Stimpson Company sells land to Barker Company for $2.5 million then immediately leases it back. The relevant information is as follows: 1. The land was carried on Stimpson's books...

-

On January 1, 2013, Nelson Company leases certain property to Queens Company at an annual rental of $60,000 payable in advance at the beginning of each year for 8 years. The first payment is received...

-

On January 1, 2013, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions: The lease is noncancelable...

-

Solve (2.4 x 10-5) X 875 (2.5 x 107) x (2.8 x 107)

-

assume there are no outliers. Draw the boxplot for the following frequency table. You may X f rf cf crf 3 7 0.1228 7 0.1228 4 11 0.1930 18 0.3158 5 9 0.1579 27 0.4737 618 6 0.1053 33 0.5789 10 0.1754...

-

Find the partial derivative of the regularized least squares problem: {) (w + x) (wo + w x ( ) + w x ( ) } + |/\||[w1, w2]|| with respect to wo, w, and w2. Although there is a closed-form solution to...

Study smarter with the SolutionInn App