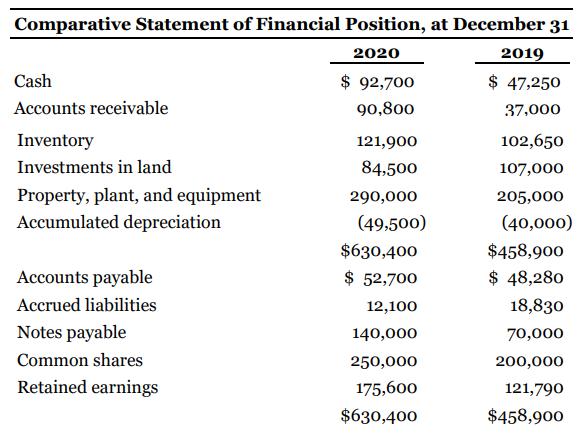

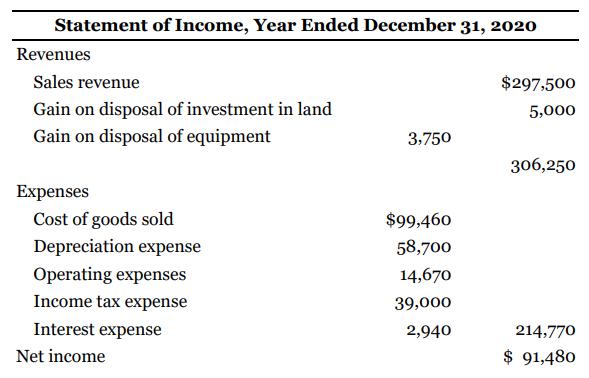

Information from the statement of financial position and statement of income is given below for North Road

Question:

Information from the statement of financial position and statement of income is given below for North Road Inc., a company following IFRS, for the year ended December 31. North Road has adopted the policy of classifying interest paid as operating activities and dividends paid as financing activities.

Additional information:

1. Investments in land were sold at a gain during 2020.

2. Equipment costing $56,000 was sold for $10,550, resulting in a gain.

3. Common shares were issued in exchange for some equipment during the year. No other shares were issued.

4. The remaining purchases of equipment were paid for in cash.

Instructions

a. Prepare a statement of cash flows for the year ended December 31, 2020, using the indirect method.

b. Prepare the operating activities section of the statement of cash flows using the direct method.

c. If North Road Inc. had followed ASPE, would it have a choice in how it classifies dividends paid on the statement of cash flows?

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy