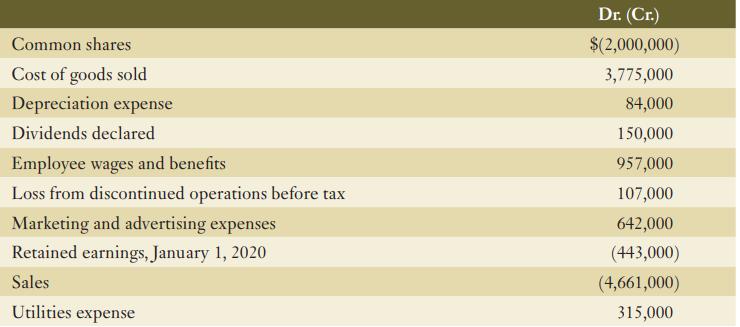

The following is a partial list of the accounts for Boot Company for the year ended December

Question:

The following is a partial list of the accounts for Boot Company for the year ended December 31, 2020, in alphabetical order:

During the year, the company issued shares for proceeds of $400,000. In addition, the company had a change in depreciation policy that required a retroactive adjustment that increased the prior year’s depreciation expense by $62,000. Boot pays income tax at the rate of 40%. Assume that all of the above items except for retained earnings are before tax.

Required:

Using the information above, prepare, in good form, the following:

a. A multi-step income statement that includes relevant subtotals, with operating expenses listed by their function, for the year ended December 31, 2020.

b. A statement of changes in equity for the year ended December 31, 2020.

Step by Step Answer: