Blue Ltd. engages in transactions involving foreign currencies, namely the Australian dollar and U.S. dollar. Blue Ltd.

Question:

Blue Ltd. engages in transactions involving foreign currencies, namely the Australian dollar and U.S. dollar. Blue Ltd. engaged in the following transactions during 20X9:

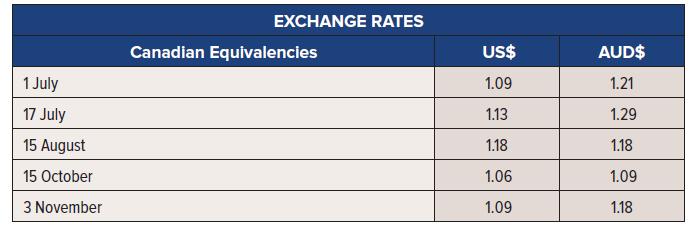

1. Purchased inventory on 1 July for 50,000 US$ on account, with payment due in 30 days.

2. Purchased inventory on 17 July for 200,000 AUD$ on account, with payment due in 90 days.

3. Purchased inventory on 15 August for 75,000 US$ on account, payment due in 90 days.

4. Paid for the entire purchase in transaction 1 on 17 July.

5. Paid for the entire purchase in transaction 2 on 15 October.

6. Paid for the entire purchase in transaction 3 on 3 November.

Required:

1. Prepare journal entries for the above transactions. Blue Ltd. maintains a perpetual inventory system.

2. Explain how the historical cost concept is applied to inventory purchased in a foreign currency.

3. Explain how an exchange gain or loss may arise relating to foreign currency payables.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel