Gunnard Ltd. was formed in 20X4 and has a 31 December year-end. Gunnard changed from successful efforts

Question:

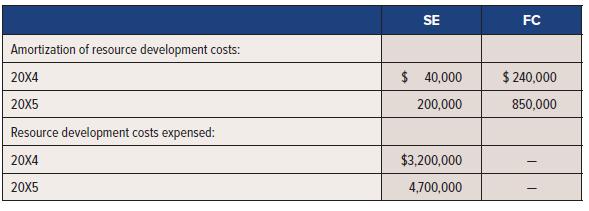

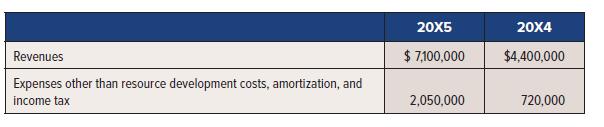

Gunnard Ltd. was formed in 20X4 and has a 31 December year-end. Gunnard changed from successful efforts (SE) to full costing (FC) for its resource exploration costs in 20X5. SE is still used for tax purposes. The new majority shareholder preferred FC. Under FC, all exploration costs are deferred; under SE, only a portion are deferred. Under both approaches, the deferred cost balance is amortized yearly.

Had FC been used in 20X4, a total of $3,200,000 of costs originally written off under SE would have been capitalized. A total of $4,700,000 of such costs were incurred in 20X5. Gunnard discloses 20X4 and 20X5 results comparatively in its annual financial statements. The tax rate is 30% in both years.

Additional information:

Required:

1. Prepare a 20X5 comparative statement of comprehensive income using the old policy, successful efforts.

2. Prepare the 20X5 entry/entries for FC amortization and the accounting change. Assume that no amortization has been recorded by Gunnard to date in 20X5.

3. Prepare the comparative statements of comprehensive income under FC, and include disclosures related to the accounting change.

4. Prepare the comparative retained earnings section of the statement of changes in shareholders’ equity for 20X5, reflecting the change.

5. How will the classification of development costs on the statement of cash flows change as a result of the new policy?

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel