Question: Jetnow Ltd. has a defined benefit pension plan for its employees. The following information was provided by the actuary: Required: Prepare a spreadsheet for 20X3

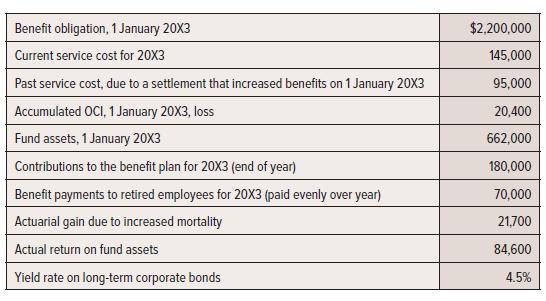

Jetnow Ltd. has a defined benefit pension plan for its employees. The following information was provided by the actuary:

Required:

Prepare a spreadsheet for 20X3 that determines pension expense and also the closing net defined benefit asset or liability account and accumulated OCI.

Benefit obligation, 1 January 20X3 Current service cost for 20X3 Past service cost, due to a settlement that increased benefits on 1 January 20X3 Accumulated OCI, 1 January 20X3, loss Fund assets, 1 January 20X3 Contributions to the benefit plan for 20X3 (end of year) Benefit payments to retired employees for 20X3 (paid evenly over year) Actuarial gain due to increased mortality Actual return on fund assets Yield rate on long-term corporate bonds $2,200,000 145,000 95,000 20,400 662,000 180,000 70,000 21,700 84,600 4.5%

Step by Step Solution

3.37 Rating (169 Votes )

There are 3 Steps involved in it

1 January 20X3 Past Service Cost Current Service Cost Net ... View full answer

Get step-by-step solutions from verified subject matter experts