Morocco Corp. initiated a defined benefit pension plan on 1 January 20X5. The plan does not provide

Question:

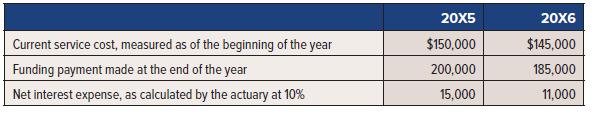

Morocco Corp. initiated a defined benefit pension plan on 1 January 20X5. The plan does not provide past service benefits for existing employees. The pension funding payment is made to the trustee on 31 December of each year. The following information is available for 20X5 and 20X6:

Required:

1. Prepare the journal entries to record pension expense for 20X5 and 20X6. Net interest in 20X6 is calculated by applying the discount rate to the net defined benefit obligation. Also record the funding payment.

2. What is the amount of the net defined benefit asset on the 31 December 20X6 statement of financial position? Prove that this is equal to the net position of fund assets and the

defined benefit obligation.

3. Explain what it means when there is a limit on the net defined benefit asset on the statement of financial position?

4. Prepare the necessary additional entry that would be made if there was an asset ceiling of $51,500 in 20X6. What is the net defined benefit asset on the 31 December 20X6 statement of financial position?

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel