Secord Limited has two classes of shares outstanding: preferred ($6 dividend) and common. At December 31, 2022,

Question:

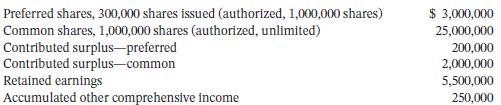

Secord Limited has two classes of shares outstanding: preferred ($6 dividend) and common. At December 31, 2022, the following accounts and balances were included in shareholders’ equity:

The contributed surplus accounts arose from net excess of proceeds over cost on previous cancellations of shares of each respective class. The following transactions affected shareholders’ equity during 2023:

Jan. 1 Issued 25,000 preferred shares at $25 per share.Feb. 1 Issued 50,000 common shares at $20 per share.June 1 Declared a 2-for-1 stock split (common shares).July 1 Purchased and retired 30,000 common shares at $15 per share. Round average cost of shares to the nearest cent.

Dec. 31 Net income is $2,100,000; comprehensive income is $2,050,000.

31 The preferred dividend is declared, and a common dividend of $0.50 per share is declared.

Secord follows IFRS.

Instructions

a. Prepare the statement of changes in shareholders’ equity and the shareholders’ equity section of the SFP for the company at December 31, 2023. Show all supporting calculations using T accounts.

b. Prepare the journal entry for the repurchase of 30,000 common shares on July 1, 2023.

c. Prepare the journal entry for the repurchase of 30,000 common shares assuming instead that the repurchase took place on May 31 at the same repurchase price of $15. Round average cost of shares to the nearest cent. What effect will the change in the date have on total shareholders’ equity?

d. How would the answer to part (a) be different if Secord followed ASPE?

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119740445

13th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy