The financial statements of Dakar Corp. for a four-year period reflected the following pre-tax amounts: Dakar has

Question:

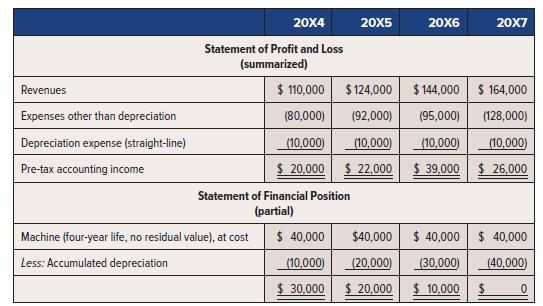

The financial statements of Dakar Corp. for a four-year period reflected the following pre-tax amounts:

Dakar has a tax rate of 40% each year and claimed CCA for income tax purposes as follows: 20X4, $16,000; 20X5, $12,000; 20X6, $8,000; and 20X7, $4,000. There were no deferred income tax balances at 1 January 20X4.

Required:

For each year, calculate the deferred income tax balance on the statement of financial position at the end of the year, and also net income.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel

Question Posted: