The pre-tax income for Xing Inc. for the first three years of operations is provided below. Xing

Question:

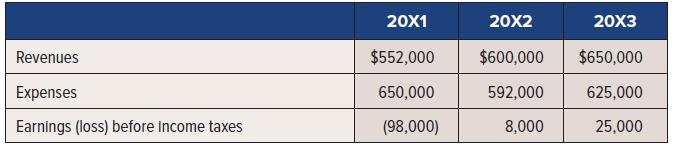

The pre-tax income for Xing Inc. for the first three years of operations is provided below.

Xing Inc. had no sources of temporary differences in 20X1, 20X2, and 20X3. The income tax rate was 34% in all three years.

In 20X1 and 20X2 management was unable to predict with certainty that there would be future profits, given Xing’s business forecasts. However, in 20X3 management’s outlook changed for the better and they then believed with certainty there would be future profits.

Required:

1. Calculate the income tax expense (recovery) for 20X1, 20X2, and 20X3 that would appear on Xing’s statement of income.

2. Prepare journal entries to record income taxes in 20X1, 20X2, and 20X3 given that Xing Inc. uses a valuation allowance approach to recording tax loss carryforward benefits.

3. Would a deferred tax asset be reported on the SFP in any of the years, and if so, how much? How would it be classified?

4. How much tax payable would be reported on the SFP in 20X2?

5. What is the benefit to Xing Inc. of using an allowance approach?

6. Would your answer for requirements 1, 2, 3, or 4 above be different if ASPE were instead adopted by Xing Inc?

7. Would your answer for requirements 1 and 2 above be different if Xing Inc. did not use the valuation allowance method?

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel