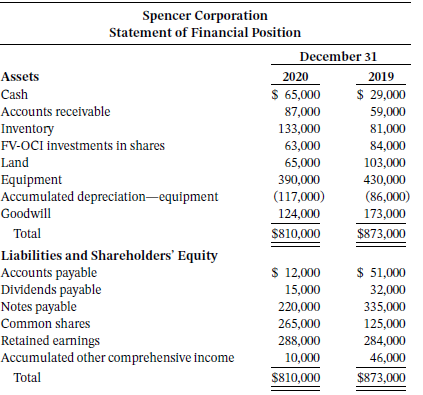

A comparative statement of financial position for Spencer Corporation follows: Additional information: 1. Net income for the

Question:

A comparative statement of financial position for Spencer Corporation follows:

Additional information:

1. Net income for the fiscal year ending December 31, 2020, was $19,000.

2. In March 2020, a plot of land was purchased for future construction of a plant site. In November 2020, a different plot of land with original cost of $86,000 was sold for proceeds of $95,000.

3. In April 2020, notes payable amounting to $140,000 were retired through the issuance of common shares. In December 2020, notes payable amounting to $25,000 were issued for cash.

4. FV-OCI investments were purchased in July 2020 for a cost of $15,000. By December 31, 2020, the fair value of Spencer?s portfolio of FV-OCI investments decreased to $63,000. No FV-OCI investments were sold in the year.

5. On December 31, 2020, equipment with an original cost of $40,000 and accumulated depreciation to date of $12,000 was sold for proceeds of $21,000. No equipment was purchased in the year.

6. Dividends on common shares of $32,000 and $15,000 were declared in December 2019 and December 2020, respectively. The 2019 dividend was paid in January 2020 and the 2020 dividend was paid in January 2021. Dividends paid are treated as financing activities.

7. A loss on impairment was recorded in the year to reflect a decrease in the recoverable amount of goodwill. No goodwill was purchased or sold in the year.

Instructions

a. Prepare a statement of cash flows using the indirect method for cash flows from operating activities along with any necessary note disclosure.

b. Digging Deeper From the perspective of a shareholder, comment in general on the results reported in the statement of cash flows.

PortfolioA portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy