Bedrock Quarries Ltd. (Bedrock), wholly owned by Betty Rubble, has operated a sand and gravel pit since

Question:

Mr. Harrison, the senior partner of Harrison, Longo, and Chan (HLC), Chartered Accountants, and a cousin of Ms. Rubble, has recently been informed that a complaint was made to the Provincial Institute of Chartered Accountants (PICA) regarding his involvement with Bedrock. In February 2016, Mr. Flintstone submitted a complaint to the PICA alleging that HLC, and Mr. Harrison in particular, were associated with financial statements of Bedrock that were false and materially misleading. Apparently, Mr. Flintstone has retained counsel and is preparing to commence legal action against HLC for negligence in its work on the Bedrock engagements.

For each of the fiscal years ended January 31, 2012, and January 31, 2013, HLC prepared audited reports, and for the fiscal years ended January 31, 2014, and January 31, 2015, HLC prepared review engagement reports on the financial statements of Bedrock. Mr. Harrison is adamant that Bedrock€™s financial statements were prepared in accordance with International Financial Reporting Standards.

The PICA does not have the staff available at the moment and has asked Chapman & Partner (CP), Chartered Accountants, to investigate Mr. Flintstone€™s complaint. You are employed by CP. Jim Chapman, partner in charge of CP€™s litigation department, has asked you to prepare a memo discussing all relevant matters regarding the engagement. He will use it as a basis for discussion in a meeting he has scheduled for next week, on May 12, 2016, with staff from the PICA.

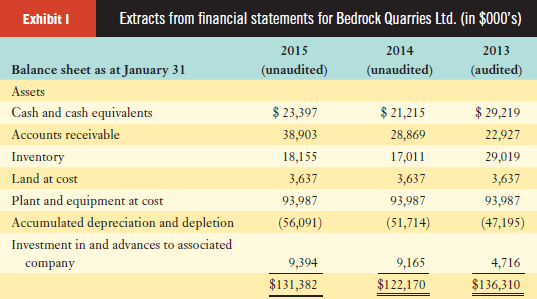

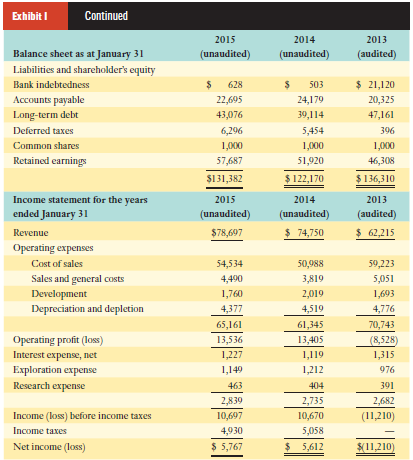

In order to prepare your memo, you have been provided with extracts from Bedrock€™s financial statements for the years 2013 to 2015 (see Exhibit I).

You have reviewed the working paper files of HLC and have held discussions with Mr. Flintstone. All significant issues arising from your investigation, including your discussions, are outlined in Exhibits II and III. Key points from the purchase and sale agreement are summarized in Exhibit IV .

Required:

Prepare the memo.

Exhibit II

Based on your review of HLC€™s working papers, you have learned the following:

1. Materiality for the engagements was set at 1% of revenue for each year.

2. No review of subsequent events was conducted for any fiscal year.

3. A letter of representation was obtained from management in each fiscal year stating that no contingencies or commitments existed, that no unusual transactions had occurred, and that the financial statements were complete. Also, specific items mentioned include the following:

- Related-party transactions did exist.

- Inventory was counted, costed, and valued fairly.

4. In each year, one HLC staff member attended the year-end inventory count to observe the procedures employed by Bedrock staff for the physical count and valuation of inventory. Every year, accounts receivable were reviewed for mathematical accuracy.

5. Harrison€™s fees for each year were based on 1% of sales or $200,000, whichever was less, and the fees could not exceed a quotation from any accounting firm of similar size and expertise.

6. Accounts receivable include amounts owed to Bedrock by Rubble Sales and Haulage Ltd., a company owned by Ms. Rubble.

7. The bank loan is secured by an assignment of accounts receivable and land and equipment.

The accounting policies of Bedrock include the following:

1. Inventory is valued at net realizable value.

2. Revenue is recognized when products are ready for delivery.

3. Depreciation and depletion are calculated on a 10-year straight-line basis.

Exhibit III

From discussions with Mr. Flintstone, you have learned the following:

1. Mr. Flintstone initially heard of Bedrock€™s financial results and financial position from a friend of Mr. Harrison who had periodically discussed Bedrock€™s operations with Mr. Harrison.

2. Mr. Flintstone relied upon the Bedrock financial statements for the years 2012 to 2014 before entering into the purchase and sale agreement.

3. Mr. Flintstone claims that during a meeting on August 15, 2014, HLC assured him that the financial statements of Bedrock were free of any material errors for each of the fiscal years 2012 to 2014.

4. Mr. Flintstone reviewed the draft 2015 financial statements prior to closing the deal.

5. Mr. Flintstone had no knowledge of the nature and extent of HLC€™s procedures for 2015.

6. Mr. Flintstone considers himself very knowledgeable about the industry.

Exhibit IV

1. The purchase price of Bedrock€™s shares is $100 million plus three times net income for the fiscal years 2015 and 2016.

2. HLC will remain Bedrock€™s accountants for fiscal 2016, after which the auditors of Flintstone Sand and Gravel will assume the engagement.

3. Ms. Rubble provided a general representation and warranty in the purchase and sale agreement that all financial statements of Bedrock are true and correct.

4. Flintstone Sand and Gravel is entitled to have access to all of Bedrock€™s corporate records in the course of its due diligence procedures.

Step by Step Answer: