Question: Button Company has the following two temporary differences between its income tax expense and income taxes payable. The income tax rate for all years is

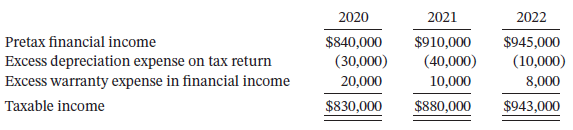

Button Company has the following two temporary differences between its income tax expense and income taxes payable.

The income tax rate for all years is 20%.

Instructions

a. Assuming there were no temporary differences prior to 2020, prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2020, 2021, and 2022.

b. Indicate how deferred taxes will be reported on the 2022 balance sheet. Button?s product warranty is for 12 months.

c. Prepare the income tax expense section of the income statement for 2022, beginning with the line ?Pretax financial income.?

2021 $910,000 (40,000) 2022 2020 Pretax financial income Excess depreciation expense on tax return Excess warranty expense in financial income Taxable income $840,000 (10,000) 20,000 10,000 8,000 $830,000 $880,000 $943,000

Step by Step Solution

3.36 Rating (168 Votes )

There are 3 Steps involved in it

a b Deferred tax asset 4000 2000 1600 7600 Deferred tax liability 6000 8... View full answer

Get step-by-step solutions from verified subject matter experts