Question: Evans Shielding Products (ESP) uses the aging method for its accounts receivable. On January 1, 2017, the balance in the allowance for doubtful accounts was

On January 1, 2017, ESP received a promissory note from a customer in exchange for a large purchase of goods from ESP. The note pays interest at 7% annually, matures on December 31, 2019, and will pay ESP $150,000 upon maturity. The market yield for this type of note is 10%.

During 2017, ESP factored $200,000 of its receivables without recourse for net proceeds of $186,000.

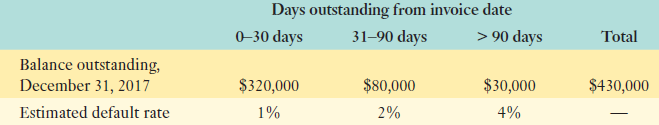

The following table is the aging schedule for ESP€™s receivables:

Required:

a. Determine ESP€™s bad debts expense for 2017.

b. Record the journal entry or entries relating to the factoring transaction.

c. Record the sale made in exchange for the promissory note.

d. For 2017, how much interest income should ESP record for the promissory note?

Days outstanding from invoice date 3190 days 030 days > 90 days Total Balance outstanding, December 31, 2017 Estimated default rate $80,000 2% $30,000 4% $320,000 1% $430,000

Step by Step Solution

3.60 Rating (168 Votes )

There are 3 Steps involved in it

a To determine BDE first determine the amount ADA using and aging schedule Days outstanding from inv... View full answer

Get step-by-step solutions from verified subject matter experts