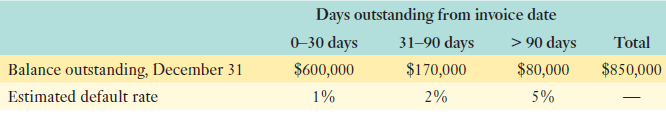

Question: Wahlberg Design Partners (WDP) uses the aging method for its accounts receivable. On January 1, the balance in the allowance for doubtful accounts was $25,000.

During the year, WDP factored $600,000 of its receivables with recourse. The company received $550,000, net of a hold-back of $20,000 for potentially uncollectible accounts. Of the total amount factored, $585,000 was collected, and the factor made a final payment to WDP for $5,000.

Required:

a. Record the journal entries relating to the factoring transaction.

b. Determine the amount of bad debts expense for the year.

c. Show the journal entry to record bad debts expense for the year.

d. Show the journal entry that was used to record write-off s for the year.

Days outstanding from invoice date 3190 days $170,000 030 days > 90 days Total Balance outstanding, December 31 $850,000 $80,000 $600,000 Estimated default rate 2% 1% 5%

Step by Step Solution

3.31 Rating (160 Votes )

There are 3 Steps involved in it

a When AR factored Dr Cash 550000 Dr Due from factor 20000 Cr Shortterm debt x assetbacked financing ... View full answer

Get step-by-step solutions from verified subject matter experts