Question: Niagara Inns provides a modest defined benefit pension for its employees. At the end of the current fiscal year, which ended on December 31, the

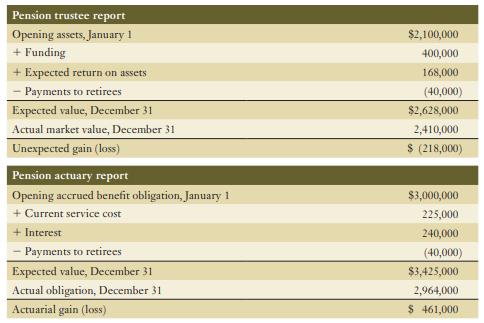

Niagara Inns provides a modest defined benefit pension for its employees. At the end of the current fiscal year, which ended on December 31, the pension plan supplied Niagara with information about the pension, which is summarized in the following tables:

The company did not have any past service costs.

Required:

Provide the journal entries for Niagara’s pension plan for the year.

Pension trustee report Opening assets, January 1 + Funding + Expected return on assets - Payments to retirees Expected value, December 31 Actual market value, December 31 Unexpected gain (loss) Pension actuary report Opening accrued benefit obligation, January 1 + Current service cost + Interest Payments to retirees Expected value, December 31 Actual obligation, December 31 Actuarial gain (loss) $2,100,000 400,000 168,000 (40,000) $2,628,000 2,410,000 $ (218,000) $3,000,000 225,000 240,000 (40,000) $3,425,000 2,964,000 $ 461,000

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Debit Pension ... View full answer

Get step-by-step solutions from verified subject matter experts