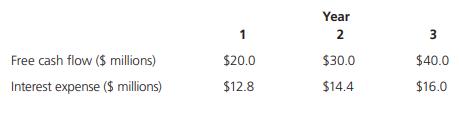

Sheldon Corporation projects the following free cash flows (FCFs) and interest expenses for the next 3 years,

Question:

Sheldon Corporation projects the following free cash flows (FCFs) and interest expenses for the next 3 years, after which FCF and interest expenses are expected to grow at a constant 7% rate. Sheldon’s unlevered cost of equity is 13%; its tax rate is 25%.

a. What is Sheldon’s unlevered horizon value of operations at Year 3?

b. What is the current unlevered value of operations?

c. What is the horizon value of the tax shield at Year 3?

d. What is the current value of the tax shield?

e. What is the current total value of the company?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Financial Management

ISBN: 9780357516669

14th Edition

Authors: Eugene F Brigham, Phillip R Daves

Question Posted: