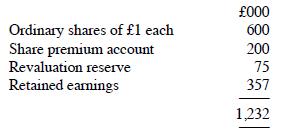

A company's statement of financial position as at 31 December 2022 shows the following components of equity:

Question:

A company's statement of financial position as at 31 December 2022 shows the following components of equity:

The information given below is for the year to 31 December 2023. Assume that all items mentioned are considered to be material.

(a) When preparing its financial statements for the year to 31 December 2023, the company discovered that an accounting error had been made in the previous year. As a result of this error, the company's profit after tax for the year to 31 December 2022 had been overstated by £83,000.

(b) On 31 December 2023, a piece of land owned by the company (and shown at cost in the previous year's financial statements) was revalued, giving rise to a revaluation gain of £38,000. This gain was credited to the revaluation reserve.

(c) In July 2023, the company disposed of a freehold property that had been revalued in 2021. The revaluation in 2021 gave rise to a revaluation gain of £25,000 which was credited to the revaluation reserve. Accordingly, on disposal of the property in July 2023, £25,000 was transferred from revaluation reserve to retained earnings.BStandard IAS16 permits transfers of this nature (see Chapter 5 for more details).

(d) In May 2023, the company made a 1 for 20 bonus issue of ordinary shares, financed out of the share premium account. In November 2023, a further issue of 120,000 ordinary shares was made at £1.80 per share.

(e) The company's pre-tax profit for the year to 31 December 2023 was £112,000. The tax expense was £23,000. Dividends paid in the year amounted to £15,000. A final dividend of £30,000 for the year to 31 December 2023 will be paid in March 2024. Prepare the statement of changes in equity for the year to 31 December 2023.

Step by Step Answer:

International Financial Reporting a practical guide

ISBN: 9781292439426

8th Edition

Authors: Alan Melville