An asset which cost 200,000 on 1 January 2021 is being depreciated on the straight line basis

Question:

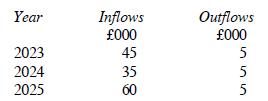

An asset which cost £200,000 on 1 January 2021 is being depreciated on the straight line basis over a five year period with an estimated residual value of £40,000. The company which owns the asset has conducted an impairment review at 31 December 2022 and estimates that the asset will generate the following cash flows over the remainder of its useful life:

The cash inflow for 2025 includes the estimated residual value of £40,000. The asset could be sold on 31 December 2022 for £110,000. Disposal costs would be £6,000.

(a) Determine the asset's value in use, assuming that all cash flows occur at the end of the year concerned and using a discount rate of 8%.

(b) Determine the asset's recoverable amount.

(c) Calculate the amount of the impairment loss that has occurred and explain how this should be accounted for.

(d) Calculate the amount of depreciation that should be charged in relation to the asset for each of the remaining years of its useful life.

Step by Step Answer:

International Financial Reporting a practical guide

ISBN: 9781292439426

8th Edition

Authors: Alan Melville