Klarke plc acquired a subsidiary company, Cameroon Ltd, on 1 October 2022. The statements of financial position

Question:

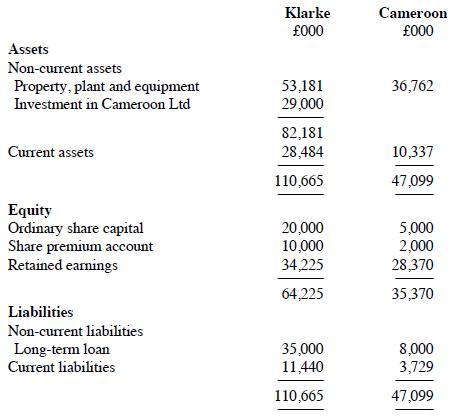

Klarke plc acquired a subsidiary company, Cameroon Ltd, on 1 October 2022. The statements of financial position of Klarke plc and Cameroon Ltd as at 30 September 2023 are as follows:

Additional data:(i) The share capital of Cameroon Ltd consists of ordinary shares of £1. There were no changes to the balances of share capital and share premium during the year. No dividends were paid or proposed by Cameroon Ltd during the year.(ii) Klarke plc acquired 3,000,000 shares in Cameroon Ltd on 1 October 2022.(iii) At 1 October 2022, the retained earnings of Cameroon Ltd were £24,700,000.(iv) The fair value of the non-current assets of Cameroon Ltd at 1 October 2022 was £37,000,000. The carrying amount of the company's non-current assets on that date was £33,000,000. The revaluation has not been recorded in the books of Cameroon Ltd (ignore any effect on the depreciation for the year). There were no other differences between the book value and the fair value of the other assets and liabilities of Cameroon Ltd at the date of acquisition.(v) The directors have concluded that goodwill on the acquisition of Cameroon Ltd has been impaired during the year. They estimate that the impairment loss amounts to 20% of the goodwill.

Required:Calculate the following figures in relation to the acquisition of Cameroon Ltd which will appear in the consolidated statement of financial position of Klarke plc at 30 September 2023:(a) The non-controlling interest(b) The goodwill arising on acquisition(c) The consolidated retained earnings of the group.

Step by Step Answer:

International Financial Reporting a practical guide

ISBN: 9781292439426

8th Edition

Authors: Alan Melville