On 1 January 2023, Glassmere Ltd (which prepares accounts to 31 December) enters into a lease for

Question:

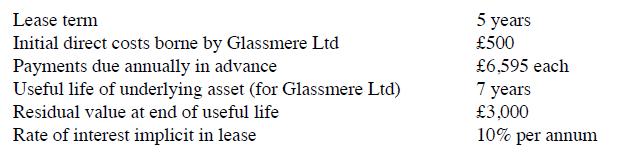

On 1 January 2023, Glassmere Ltd (which prepares accounts to 31 December) enters into a lease for the use of an asset. Details of the lease agreement are as follows: Glassmere Ltd will obtain legal ownership of the asset at the end of the lease term. The company calculates depreciation on the straight-line basis.Calculate the finance charge and the depreciation charge which should be shown in the company's financial statements for each of the years to 31 December 2023, 2024, 2025, 2026 and 2027. Also calculate the liability to the lessor at the end of each year and show how this should be split between current liabilities and non-current liabilities.

Glassmere Ltd will obtain legal ownership of the asset at the end of the lease term. The company calculates depreciation on the straight-line basis.Calculate the finance charge and the depreciation charge which should be shown in the company's financial statements for each of the years to 31 December 2023, 2024, 2025, 2026 and 2027. Also calculate the liability to the lessor at the end of each year and show how this should be split between current liabilities and non-current liabilities.

Lease term Initial direct costs borne by Glassmere Ltd Payments due annually in advance Useful life of underlying asset (for Glassmere Ltd) Residual value at end of useful life Rate of interest implicit in lease 5 years £500 £6,595 each 7 years £3,000 10% per annum

Step by Step Answer:

The initial lease liability is 6595 x 111 111 2 111 3 111 4 20905 The finance charge for ...View the full answer

International Financial Reporting a practical guide

ISBN: 9781292439426

8th Edition

Authors: Alan Melville

Students also viewed these Business questions

-

On 1 January 2019, Glassmere Ltd (which prepares accounts to 31 December) enters into a lease for the use of an asset. Details of the lease agreement are as follows: Glassmere Ltd will obtain legal...

-

On 1 January 2019 a company that prepares accounts to 31 December enters into a five-year lease of a machine from a developer. Lease payments are 50,000 per annual, payable at the end of the year....

-

Glassmere Ltd (which applies IAS17) prepares accounts to 31 December each year. On 1 January 2014, the company acquired an asset by means of a finance lease. Details of the lease agreement are as...

-

The advantages of the computerized conversion process model " What is the EOQ model? (For self-study and research) What is JIT? (Self study and research) A firm expects to sell 2000 units of its...

-

The city of Clinton was incorporated on January 1, 2014. On December 31, 2019, a careful study of the citys records revealed the following information regarding long-term debt: a. General obligation...

-

In January, Tongo, Incorporated, a branding consultant, had the following transactions. Indicate the accounts, amounts, and direction of the effects on the accounting equation under the accrual...

-

A consumer advocacy agency, Equitable Ernest, is interested in providing a service that allows an individual to estimate their own credit score (a continuous measure used by banks, insurance...

-

The post-closing trial balance of Hokie Manufacturing Co. on April 30 is reproduced as follows: During May, the following transactions took place: a. Purchased raw materials at a cost of $45,000 and...

-

You are given the following information about aggregate demand at the existing price level for an economy: (1) consumption = $500 billion (2) investment = $50 billion (3) government purchases = $10...

-

The audit firm of DCG, LLP is performing an audit of Argo Co., a publicly traded company, for the year ending December 31, 2014. You have been given the assignment of assisting in the planning...

-

Yeng and Sons Ltd prepares financial statements to 31 May each year. On 25 January 2023, the company classifies a disposal group as held for sale. This disposal group is eventually sold in August...

-

(a) Identify the circumstances in which a cost formula may be used to establish the cost of inventories.(b) A company's inventories at 30 April 2024 include 11,000kg of a chemical which is utilised...

-

On 1 January 20x4, P Co acquired 90% of S Co. Details of S Co as at the date of acquisition are as follows: Remaining useful life for the fixed assets as at acquisition date was five years and...

-

Please explain what is Customer touch point , and how customer touch point has change in digital era? Explain the four ( 4 ) touch / contact points between marketers and consumers, stating the level...

-

2. What is the de Broglie wavelength for a relativistic particle with energy , rest mass m, given Planck's constant h and speed of light c?

-

FCF for firm Canyon Shopping Center (CSC) is listed in the table . After year 4 FCF is expected to grow at a constant rate of 2%. The weighted average cost of capital for CSC is 7%. If cash = $10...

-

Find the magnitude of the force on a -7.91-C charge moving with velocity 2.2 m/s north in a uniform magnetic field of 2.59 T east. Answer in units of N.

-

How does international trade impact the economy of a country?

-

The Environmental Protection Agency provides fuel economy and pollution information on over 2000 car models. Here is a boxplot of Combined Fuel Economy (using an average of driving conditions) in...

-

The Alert Company is a closely held investment-services group that has been very successful over the past five years, consistently providing most members of the top management group with 50% bonuses....

-

Dalle Ltd is a UK company which has the pound sterling as its functional currency. The company has the following transactions in Euros () during the year to 31 March 2020: 1 January 2020...

-

On 1 July 2018, a UK company formed a foreign subsidiary in a country which has the Florin (Fn) as its currency. The summarised financial statements of this subsidiary for the years to 30 June 2019...

-

(a) Explain what is meant by the term "joint arrangement". (b) Distinguish between joint operations and joint ventures. Outline the accounting treatment prescribed for each of these by standard...

-

The following information for Blossom Enterprises is given below: Assets and obligations Plan assets (at fair value) Accumulated benefit obligation Projected benefit obligation December 31, 2025...

-

b. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $14,000 credit. c. Prepare the...

-

! Required information [The following information applies to the questions displayed below.] MyBnB started a home rental company on January 1. As of November 30, MyBnB reported the following...

Study smarter with the SolutionInn App