Check that if we use the pricing formula for European non-path dependent options on dividend-paying assets, but

Question:

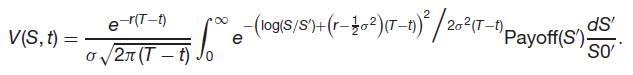

Check that if we use the pricing formula for European non-path dependent options on dividend-paying assets, but for a single asset (i.e. in one dimension), we recover the solution found in Chapter 8:

Transcribed Image Text:

e-(T-f) V(S, t) = o/27 (T - . e (log(s/s')+(r-02)(T-n)* / 202(T-n). e Payoff(S') dS So

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (12 reviews)

The provided formula is logSS T1 2 T1 VSt 2xT1 Joe 2 PayoffS dS And the standard BlackScholes formul...View the full answer

Answered By

Jehal Shah

I believe everyone should try to be strong at logic and have good reading habit. Because If you possess these two skills, no matter what difficult situation is, you will definitely find a perfect solution out of it. While logical ability gives you to understand complex problems and concepts quite easily, reading habit gives you an open mind and holistic approach to see much bigger picture.

So guys, I always try to explain any concept keeping these two points in my mind. So that you will never forget any more importantly get bored.

Last but not the least, I am finance enthusiast. Big fan of Warren buffet for long term focus investing approach. On the same side derivatives is the segment I possess expertise.

If you have any finacne related doubt, do reach me out.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

If we use the binomial probability formula (Formula 5-5) for finding the probability described in Exercise 1, what is wrong with letting p denote the probability of getting an adult who includes...

-

Equation 15.28 reports the pricing formula for the Vasicek zero coupon bond (with $1 principal). Check that it satisfies the fundamental pricing equation (Equation 15.24). That is, take the partial...

-

Use the European option pricing formula to find the value of a six-month call option on Japanese yen. The strike price is $1 = 100. The volatility is 25 percent per annum; r$ = 5.5% and r = 6%.

-

The people on Coral Island buy only juice and cloth. The CPI market basket contains the quantities bought in 2016. The average household spent $60 on juice and $30 on cloth in 2016 when the price of...

-

The bear runs at constant speed, the hiker steadily runs faster until the bear gives up and stops. The hiker slows down and stops soon after that. A bear sets off in pursuit of a hiker. Graph the...

-

As an advocate for play in the classroom, you are going to design a training workshop that will be presented to fellow teachers about: The importance of play How play contributes to social and...

-

For the HiTech example (17.1), find the risk-neutral probability of default. Example 17.1 (A leveraged firm) The HiTech firm currently has a value of $1 mil- lion and is financed in part by a 5-year...

-

Tim Howard has been offered the opportunity of investing $36,125 now. The investment will earn 11% per year and at the end of that time will return Tim $75,000. How many years must Tim wait to...

-

1. Consider the following modification to the MergeSort algorithm: divide the input array into fourths (rather than halves), recursively sort each sort each forth, and finally combine the results...

-

Lakeside Bakery bakes fresh pies every morning. The daily demand for its apple pies is a random variable with (discrete) distribution, based on past experience, given by Each apple pie costs the...

-

Using tick data for at least two assets, measure the correlations between the assets using the entirety of the data. Split the data in two halves and perform the same calculations on each of the...

-

Set up the following problems mathematically (i.e. what equations do they satisfy and with what boundary and final conditions?) The assets are correlated. (a) An option that pays the positive...

-

Let n be a positive integer. Show that 2n +2

-

Using your completed Nom vs. Real GDP Template and the Nominal vs. Real GDP Template-Samples file posted to Canvas, answer the questions below. The answers to many of these questions are in the...

-

LR decision by a comp firm 1 @ $ Which Q* is chosen? How much is total profit/total loss? MC AC P=AR=MR

-

During a reported period, the company achieved the following costs and production outputs within two consecutive periods: Period 2020 2021 Outputs (pieces) 870 940 pieces c) Solve it graphically...

-

The total money supply M is the sum of two components: bank deposits D and cash holdings C, which we assume to bear a constant ratio C/D = c, 0 < c < 1. The high-powered money H is defined as the sum...

-

$] 3 -1 2 then find c- A-(the inverse of B), d-(transpose of AjxB, and e-(the inverse of Alx(c-d). Put: at the end of each formula for c.d. and e in the MATLAB code. For each of the results (c.d.e),...

-

A long, thin rod is cut into two pieces, one being twice as long as the other. To the midpoint of piece A (the longer piece), piece B is attached perpendicularly, in order to form the inverted "T"...

-

Design an experiment to demonstrate that RNA transcripts are synthesized in the nucleus of eukaryotes and are subsequently transported to the cytoplasm.

-

Illustrate the concept that segmenting is an aggregating process by referring to the admissions policies of your own college and a nearby college or university.

-

Consider the market for off-campus apartments in your city. Identify some submarkets that have different needs and determining dimensions. Then evaluate how well the needs in these market segments...

-

Explain how positioning analysis can help a marketing manager identify target market opportunities.

-

Use matrices (row-echelon form) to solve the following system of linear equa- tions. If the system has no solution, say that it is inconsistent. 3x + 2y = 7 x+y=3

-

For the following function : f(x) = 1/3 x^3 + 4x^2 + 16x a. Determine the critical points. b. Calculate the second derivative c. Determine if the function is concave up or down or not concave d....

-

2. An activity director for a cruise ship has surveyed 240 passengers. Of the 240 passengers; 135 like swimming, 150 like dancing, 65 like games, 80 like swimming and dancing, 40 like swimming and...

Study smarter with the SolutionInn App